Worldbank on growth projection for UAE states that growth in the UAE is expected to reach 2.5% by 2022; while the world bank projection is supported by government recovery plans, higher oil prices, and production capacity with a boost from Dubai Expo2021, another contributing factor to the country’s growth is Small and medium-sized enterprises (SMEs). SME’s the backbone of a country has the potential to create jobs, innovate and contribute to economic growth.

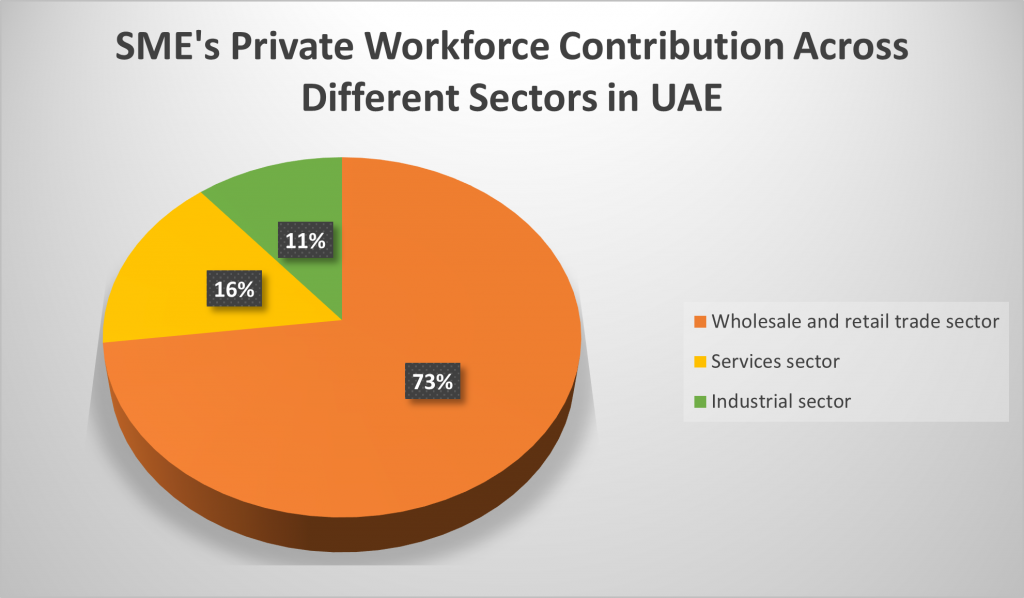

The UAE government’s strategic planning and vision 2021 highlights offer great support and recovery from pandemics. Looking at the statistics, the government projection for 2021 showcases SME participation in UAE’s non-oil economy to reach 70% [which is currently over 60%]. Categorizing based on verticals, the SMEs make up 73% of the UAE wholesale and retail sector, 16% of services, and 11% of the industrial sector.

So, although SMEs have vast potential to help an economy, they struggle with poor access to finance and insufficient cash flow. According to Fitch ratings –

Bank lending to SMEs is negligible, representing less than 5% of total loans, lower than the average in the Middle East and North Africa as well as other regions.

The government has announced a stimulus package, also urging them to embrace digital technology but still, the SMEs suffer. One of the core reasons is that SMEs in UAE are already invested in a “certain business model”, “reinvesting” or renovating comes at a price.

That’s where “fintech” can promise to be the bridge of “getting banking services” packed with hassle-free and secured wrapping.

Our post of today would speak about some of the “promising” fintech players that can offer SMEs in UAE not only easy access to credit but also seamless integration to their legacy business model.

Telr is a Dubai-based start-up offering payment gateway solutions to SMEs, government bodies, and large corporates. The platform is designed to handle complex integrations and unique payment methods. TELR offers its customers to transact in over 120 currencies with payment platform capabilities in 30 languages with a range of financial and business services that include social commerce, QR Codes, anti-fraud protection, Shopping Cart Integrations, and digital invoicing.

Hylobiz, an SME neobank helps is a complete solution for a business in need. The platform offers pre-integrated ERPs that can help accountants and bookkeepers in creating, managing to track, and most importantly reconciling by EOD. Sales and accountants can boost their business with faster collections and by managing a digital stock house for their buyers. The platform evolved to assist every business in availing Connected banking services that help them in collecting money faster, digitizing their transactions, and avail automation using integrated ERP and Bank features.

Hylobiz can assist SMEs and their accounting, sales, and marketing team with pre-integrated ERPs for real-time collections for efficient working capital with credit access benefits like loans, insurance, and business credit card.

Hyperpay, another payment gateway that saw a shift to online retail during the pandemic launched a product to allow marketplace merchants to send fast, end-to-end payments via one platform to users — be they vendors, drivers, freelancers, or service providers. The service allowed smaller merchants in the kingdom to compete with dominant international apps, as delivery-based services became vital in sustaining people through Covid restrictions

Paytabs offers buyers and sellers to pay and get paid. Their hassle-free online payment solution specifically targeted at small and medium-sized enterprises allows them to accept credit and debit card payments at reasonable rates and grow their businesses with stronger cash flow. Paytabs is currently offering its solutions in more than 17 countries across the Middle East, North Africa, and Southeast Asia.

Zbooni a social commerce platform assists small business owners and enterprises in accepting payments online, in-person, or via a POS device. It acts as a digital marketplace, enabling sales to be completed via messaging services such as WhatsApp, crucially fulfilling card payments.

Businesses, SMEs, and enterprises need a helping hand and technology could be that “assistant” to scale their growth and create more work opportunities Businesses can flourish if the owner knows “how effectively to use a tool”, Hylobiz is one such tool that can empower your business.

Get in touch with us, and we can help you with the smooth adoption of digital channels. Hylobiz one-stop solution for all your accountant, sales and business needs to reconcile, integrate ERPs, send invoices digitally, track cash and cheque collection and create a distribution channel.