SME sector contributes significantly to Indian economy. 1/3 of India’s GDP is supported by this sector. The small businesses in India are of paramount importance and help to reduce income gap, reduce poverty, increase production, generate employment and many more. With minimal investment requirement, a small business can operate even in remote areas and can show huge potentiality though with limited expertise and resources.

SME challenges

Despite of the commendable contributions and immense potential, there are multiple challenges that SME businesses face. Some of those challenges are

- handling multiple banks, ERPs, and users

- delay in payments and collections,

- delay in payment settlements,

- tedious reconciliations process

- working in silos

- little access to capital and technology

SMEs can grow and contribute remarkably if they take the support of the right fintech.

SME growth with Fintech

Fintech is the fastest growing industry and is catching the attention of digitally-minded customers. The fintech companies with the power of innovative technologies have revamped the financial system and have positively impacted SME growth. SME need the continuous support of a fintech that serves their basic needs and helps overcome the challenges.

Hylobiz, a highly secured and progressive fintech start up serves the B2B segment and is a technically unique platform that overthrows invoicing, billing, payments, collections, access to credits and many other burning SME challenges. It is partnered with leading banks/ NBFCs and is pre integrated with multiple ERPs. Any SME business can also easily integrate the existing accounts and ERPs with Hylobiz platform. This enables them to track and manage data well and manage working capital more efficiently.

Interested to know why is there a need to integrate your existing account and ERP?

Here is why.

Impact of ERP integration/ connected erp

When ERP/business tools/accounting platform is integrated with fintech platform, SMEs get the support of

- Automation of receivables and payables

- Efficient data storage and tracking

- Better management of financial details

- Accurate data analysis with reports available

- Strategizing based on available business insights

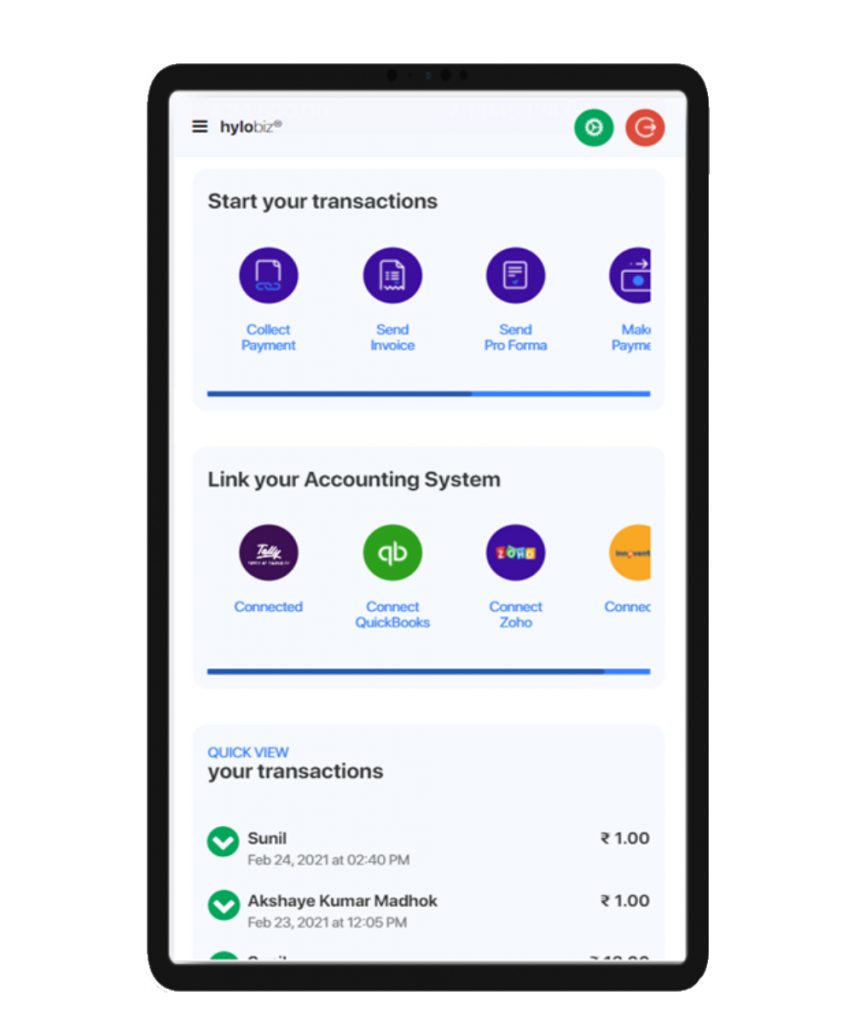

Some of the top ERPs pre-integrated with Hylobiz are Tally, Quickbooks, Zoho Books, CORALerp.

Impact of account integration/ connected banking

When bank accounts are integrated with fintech platform, SMEs get access to

- Financial services like working capital loans, eKYC, account opening and many more

- Automated Reconciliations

- Digital payments and collections

- Business insights at real-time

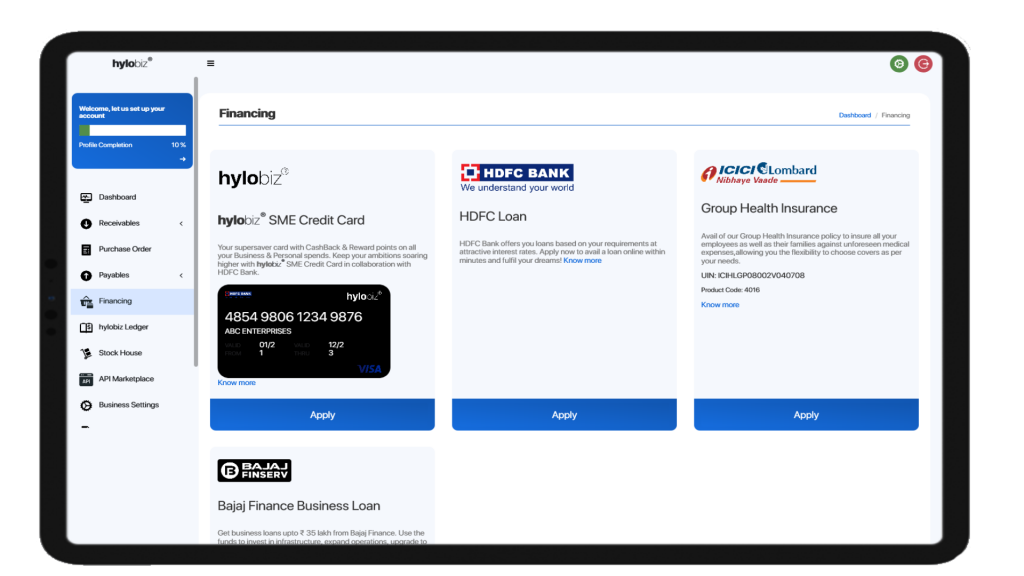

Hylobiz is in alliance with top financial institutions like Kotak Mahindra Bank, Yes bank, Bajaj finance and Neogrowth credit pvt ltd.

Hylobiz boosts SME business through connected banking and connected ERP services

It is Christmas time and New year is just a few more days ahead. Your business now needs a complete fast and reliable solution to deal with invoices, payments, and collections automatically to run your business days more effortlessly.

Download Hylobiz mobile app: google play store or app store

And Hylobiz has the solution to all your business challenges which can help you meet your new year resolution with its wholesome package of innovative tools.

Hylobiz is ISO 27001:2013 certified. Encrypted data, and secured hybrid structure ensure safety of business data and transactions at all levels.

Through connected banking and connected ERP on Hylobiz:

- Sync invoices automatically from existing ERP. You can also create/ upload and send invoices through multiple communication channels.

- Attach payment links with the invoices to collect payments on time through multiple payment modes both online and offline. You may also generate static payment links to get paid for a fixed amount repeatedly from multiple clients.

- Get paid on time with the buzz of automated reminders

- Get access to working capital loans, pre-approved SME credit cards, invoice / bill discounting, insurance with our financial partners

- Bajaj finance and Neogrowth Credit Pvt Ltd offer working capital loans

Click here to avail loans from Bajaj Finserv

- Yes bank and Kotak bank offer connected banking services

- HDFC offers preapproved SME credit cards

- Get access to integrated payment gateway. You can automate vendor payments, create purchase orders, and pay out without delay

- Get access to quick settlements and automated reminders

- The real-time dashboard and automated reports help to provide a visibility of cash flow on real-time and give access to business insights

Top 3 blogs speaking about ERP and account integration in SME growth

1. How connected ERP and connected banking can improve SME payment and collection? Click here

2. Should banks and ERPs tie up with fintech to improve services to their SME business customers? Click here

3. How consumer lending process is experiencing a transformation with connected ERP and connected banking Click here

We are happy that our customers are satisfied😊

These positive feedbacks are driving our motivation towards continuous innovation.

Sign up for free

Read our unique composition to know our top features briefly that can help your business grow with Hylobiz and keep you ahead of the competition.

Want to be a part of our growing network and contribute to the growth of a network of networks?

You can be a part of the niche that benefits out of connected ERP and connected banking.