Do you know that working capital is the lifeblood of your business?

It’s the cash you have on hand to pay bills, meet payroll, make payments to vendors etc. Simply put, working capital is the difference between your current assets and current liabilities.

Your current assets include cash, inventory, and accounts receivables, while your current liabilities include bills, loans, and other payments that are due in the near term.

It’s essential to manage working capital effectively, especially if you’re a small or medium-sized enterprise. You may face cash flow challenges such as slow-paying customers and extended payment terms from suppliers, which can impact your ability to manage your working capital effectively.

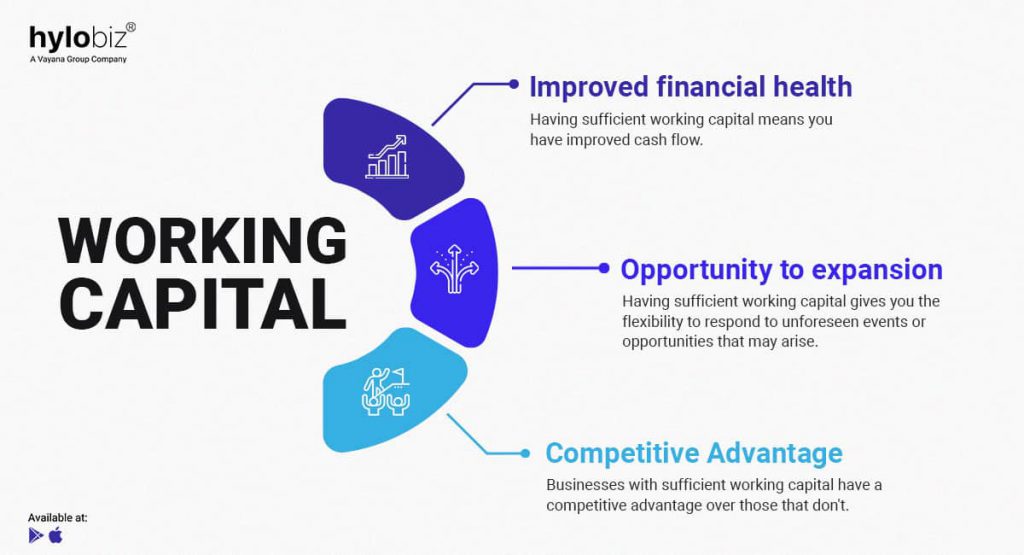

Importance of Working Capital for your Business? Let’s Explore Some of the Advantages

- Improved financial health

Having sufficient working capital means you have improved cash flow, which is essential for your business to operate efficiently. With more cash on hand to cover your expenses and invest in growth opportunities, you can improve your overall financial health. - Opportunity to expansion

Having sufficient working capital gives you the flexibility to respond to unforeseen events or opportunities that may arise. You can invest in new projects or initiatives, expand your operations, or weather economic downturns. - Competitive Advantage

Businesses with sufficient working capital have a competitive advantage over those that don’t. You can offer better payment terms to customers, negotiate better deals with suppliers, and invest in marketing and other growth initiatives.

However, managing your working capital can be a challenge.

That’s where Hylobiz comes in

We offer a platform that helps businesses streamline their accounts receivables and payables processes, reducing the time and effort it takes to manage cash flow.

By automating the invoicing and payment collection process, our platform can help you get paid faster, which means you have more cash on hand to cover your expenses. And by automating the payment collection process, you can manage your accounts payable better, reducing the risk of late payments and penalties.

Moreover, we offer a range of financial services, including invoice financing and supply chain finance, that can help you access capital more efficiently. By using our platform, you can improve your creditworthiness and access better financing options from banks and financial institutions.

So, How can Hylobiz Help you Manage Working Capital Effectively? Here are Some of the Ways

Firstly – our platform automates the invoicing process, which means you can get paid faster. Faster payments mean more cash on hand to cover expenses and invest in growth opportunities.

Secondly – our platform automates the payment collection process, making it faster and more efficient. This means you can manage your accounts payable better, reducing the risk of late payments and penalties.

Thirdly – Hylobiz offers a digital platform that allows businesses to track their financial transactions, unpaid invoices, and cash flow through its digital ledger and dashboard, which can help improve access to working capital loans.

By providing banks and other financial institutions with accurate and up-to-date records of their financial health, businesses can increase their chances of accessing better financing options.

With the Hylobiz platform, businesses can access a comprehensive set of tools that can help them manage their SME finances effectively, avoid mistakes and errors, and ultimately grow and succeed over the long term.

Lastly, we offer a range of financial services, including invoice financing and supply chain finance, that can help you access capital more efficiently.

In Conclusion, Managing Working Capital is Critical to the Success of your Business

Hylobiz is here to help SMEs overcome cash flow challenges and achieve their goals. With our platform, businesses can streamline their cash flow processes, improve their creditworthiness, and access capital more efficiently.

Remember, “Cash flow is the lifeblood of business,” and with Hylobiz, you can ensure your business’s financial health in your own customized dashboard to view your dashboard click here.

So, if you’re a business looking to manage working capital more effectively, give Hylobiz a try and see how we can help your business thrive request a demo

Sign up today: https://app.hylo.biz/login

Know more on Hylobiz: https://hylo.biz/

Read more of our blogs: https://hylo.biz/blogs/

Reach us: support@hylobiz.com