In today’s fast-changing environment, technology has disrupted the banking business and its product offerings. Small Businesses are also experiencing advancements and regulatory changes led by technology.

Businesses also need something more than banking to cope up with this fast-changing environment. So, here comes the concept of connected banking.

Firstly, let us know what does connected banking mean?

In connected banking, banks provide an advanced platform to businesses with all of their financial products and services with an advanced level of security. It also helps banks in generating different income streams and in reimagining banking for businesses.

Hylobiz is in partnership with multiple financial institutions and helps banks and NBFCs to offer their financial services digitally to a wider range of business customers on its financial marketplace, to reduce operational costs and get the benefits of technological innovation.

This technological advancement in the banking space has helped businesses in many ways like creating a better customer experience, generating higher ROI, and reducing operational costs. Through this automation in banking SMEs and other businesses enjoy higher efficiency and quick settlements, which also improves the cash flow position of their business. Businesses can integrate their bank account with Hylobiz, get access to better technology, and need no more juggle with multiple ERPs, banks, manual entries, and payment gateways.

Why do SMEs need connected banking?

- To integrate their business functions

- To save themselves from manual reconciliation

- To build better products and customer experience

- To improve business efficiency and ROI

- For the faster collection of invoices

- Timely payment to their vendors

Connected banking has restructured the whole banking process. It has helped banks in building a better customer experience along with a reduction in costs.

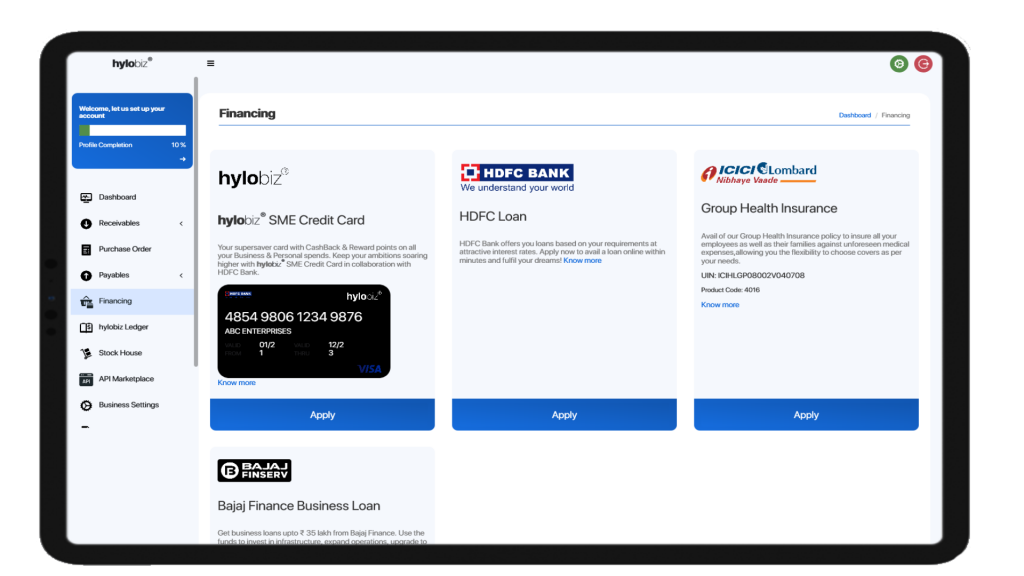

Now, businesses can open a bank account, apply for loans/ credit cards with a single click through the mobile app/web. Also, this leads to better-customized product innovations.

Read more on how fintech and bank collaboration shape the future of SME businesses: https://hylo.biz/how-can-fintech-and-bank-collaborations-shape-the-future-of-sme-businesses/

The benefits of connected banking are:

Improved collections

Connected banking plays a crucial role in businesses to improve their collection efficiency. It offers many payment modes to collect payments from customers, which results in faster collections of invoices.

Read more on how connected banking and connected ERP can improve SME payments and collections: https://hylo.biz/how-connected-erp-and-connected-banking-can-improve-sme-payments-and-collections/

Automate vendor payments

You can automate your vendor payments, which improves the business relationship. Also, you need not remind any due dates and thus enjoy a better negotiation with your suppliers.

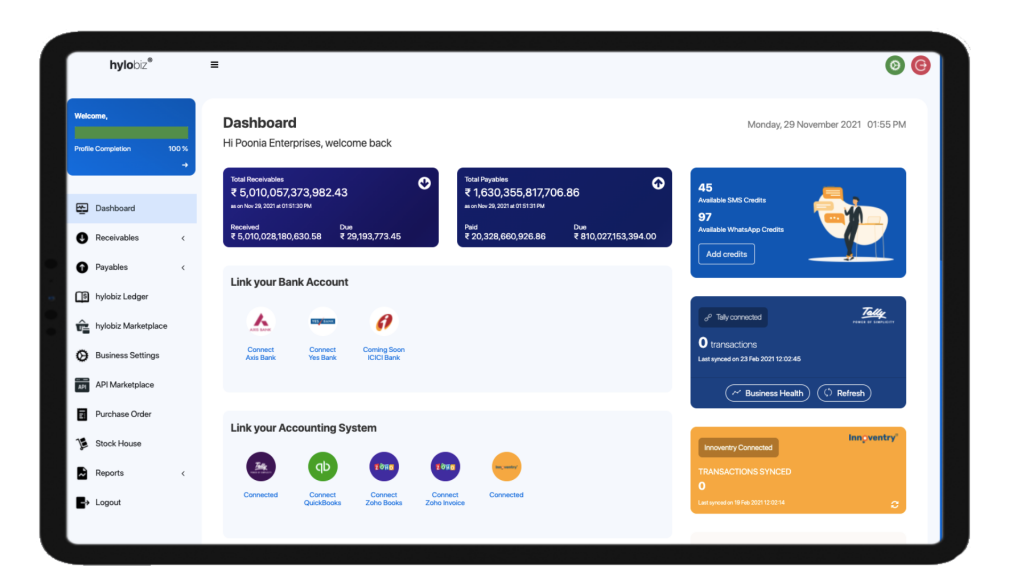

Integrated dashboard

With connected banking, you get access to an integrated dashboard where you can track, manage your business with the comfort of sitting at your home. You also enjoy access to real-time updates on business health, which improves decision-making.

Easily accessible

You can access all business transactions, payments, reconciliations, and much more anytime-anywhere. Also, enjoy automated reconciliation and detailed insights on your business.

Also, you can apply for lending products such as credit cards, business loans with a single click and get disbursed within hours.

Read more on how consumer lending is experiencing a transformation with connected banking: https://hylo.biz/how-consumer-lending-process-is-experiencing-a-transformation-with-connected-erp-and-connected-banking/

High operational efficiency

With a customer-centric approach and connected banking businesses are achieving high operational efficiency and reduction in cost. It also helps in building a better customer experience and in achieving higher ROI.

Read more on how banks and ERPs tie-up with fintech help SME businesses to improve their services: https://hylo.biz/should-banks-and-erps-tie-up-with-fintech-to-improve-services-to-their-sme-business-customers/

Hylobiz is a fintech startup where SMEs can integrate their existing ERPs at zero set-up cost. It helps SMEs in tracking, managing, and collecting payments through its tailor-made solutions.

It helps in digitizing the payables and collections of a business. Hylobiz comes with plug and plays solution with an integrated payment gateway, which helps in the faster collection of receivables. You need not chase any invoice, send automated payment reminders when payment becomes due.

Also, automate your vendor payments, utility payouts, and staff salaries and enjoy an improved relationship with your stakeholders.

Hylobiz offers you a dashboard that gives you real-time access to your business health, cash flows, and various other business reports, which improves your decision-making.

You can create the invoice of your own choice, share invoices with attached payment links through many channels such as text, Whatsapp, and email. You can share your static payment link with your customers, attach them to your social media handles.

Hylobiz also helps you in placing purchase orders, managing your inventory on the go, and get notified about the low running inventory. Through this, you can save your cash flows from piling up in excess inventory.

Now Kotak Mahindra Bank and YES Bank customers can directly link their bank accounts on the Hylobiz platform and enjoy connected banking services at low transactional cost.

At Hylobiz we have partnered with Bajaj Finserv and Neogrowth credit private limited to provide SMEs with easy and quick business loans at lower rates. Bill discounting and SME credit cards can help you get interest-free credit for up to 48 days. All these options help an SME in better management of its working capital.

We are also looking for more banking partnerships. If interested click here: https://hylo.biz/offerings-banks/

Read more on how banking partnerships can help SME businesses: https://hylo.biz/how-bank-and-fintech-partnerships-work-in-2021/

Hylobiz is an ISO-certified organization, which maintains bank-grade security. Hence all your transactions are safe and secured with two-factor authentication.

Hylobiz helps your business to grow and achieve maximum efficiency.

Are you a business struggling to manage your business health? Register here: https://hylo.biz/neobank/Login

Reach us at: support@hylo.biz