Small and medium-sized enterprises (SMEs) meet many challenges and hurdles in running and growing their businesses. At the very core of every business is its ability to take in revenue (to sell) and to secure its supply of inventory and other inputs (to buy).

But with ~30% of payments to businesses are delayed, beyond the 30-day invoice terms making it hard for SMEs to survive and expand. If a business had to spend a day/or two every week chasing payments, just imagine the mental stress that the owner goes through. Not to forget the impact of late payments that can hamper his business with restricted cash flow.

While on one hand, the governments are working to simplify the processes, how could an SME ensure to get paid on time? Are there any tips for streamlining the payments for businesses? Our post of today will help with some tips for the SMEs in speeding up their payments. Let’s get started –

Giving your customers an easy way to pay – via invoice linked digital payment links

Why do people use Debit Cards/Credit Cards/Netbanking? Does it offer convenience? Many e-commerce portals also offer a way to store your card details and simple one click and payment is done to avoid all the data entry part.

You also need to consider “Offering Convenience” to your buyer for payments.

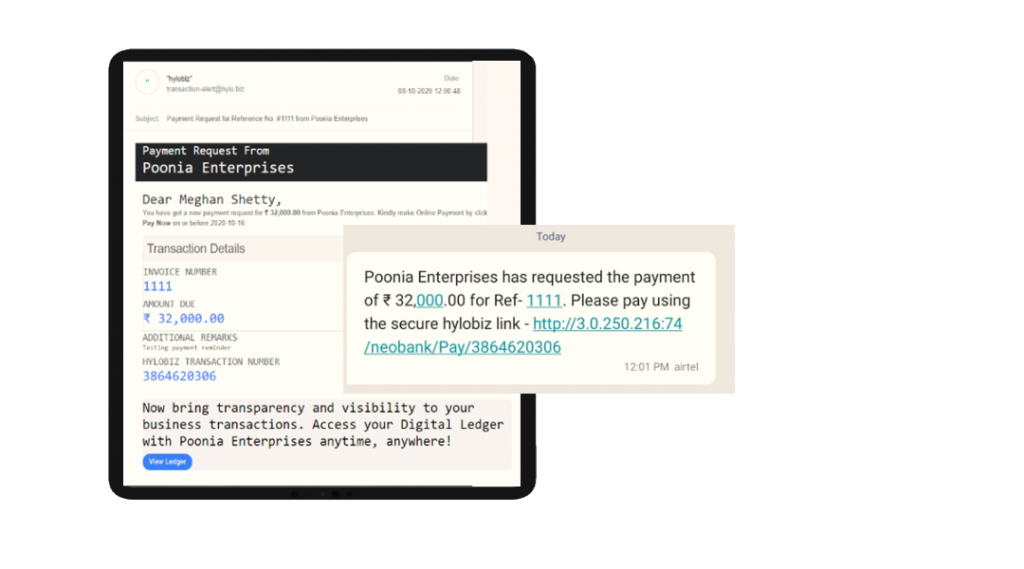

While many businesses set up an Auto-debit facility for their suppliers that debits the amount on the due date, it has its pros and cons. However, offering a One-click payment link is one of the apt features for your customer to pay you on time. It helps the buyer in “reverifying” the invoice and then making a payment with no chance of error.

Opting for digital payment mode also ensures that your accounts are updated in real-time and in case of disputes, a digital record always helps.

How Hylobiz Can Help SME’s

Hylobiz Receivables help you in sending a secured payment link with multiple payment options like Credit Card/Debit Card, NetBanking, Gpay/Paytm, etc to your customers, simplifying your digital collection process.

Digital ledger exchange with your customers for periodic sync and transparency on dues

Keeping a File and Folder to manage your accounts is a thing of the past, but have you moved to a solution that not only helps you in sending invoices but is accessible from anywhere, is mobile friendly? And provides a transparent view of your payables and receivables?

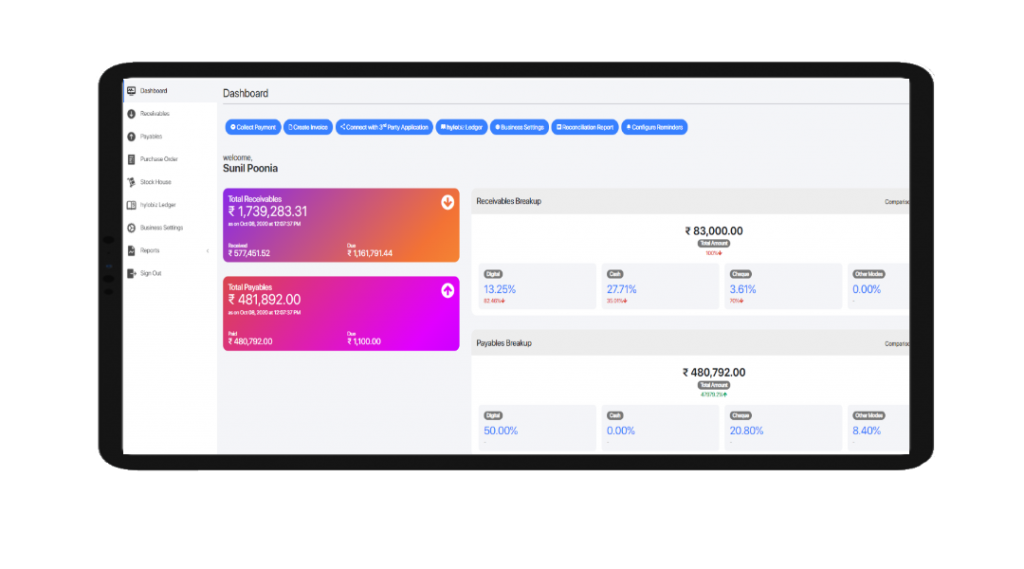

Adopting a cloud-based solution could be the best bet if you are seeking payments on time and managing your finances better. Ability to collaborate with the team, reimburse employee expenses, send payment reminders on the go, customize invoice template from anywhere, keeps your inventory in check, and have a dashboard that shows you your receivables and payable in real-time. This all is possible with a cloud-based platform.

How Hylobiz Can Help SME’s

Hylobiz, a connected banking platform is a cloud-based solution that offers Professional, SME’s and Enterprises in Digital collections, managing their stocks [as products/services], access to branded invoices, sending payment links, tracking on online and offline [cash/cheque] collections and most importantly automatic reconciliation that offers a real-time view of receivables and payables.

Configure your ERPs with a click for hassle-free communication with your buyers.

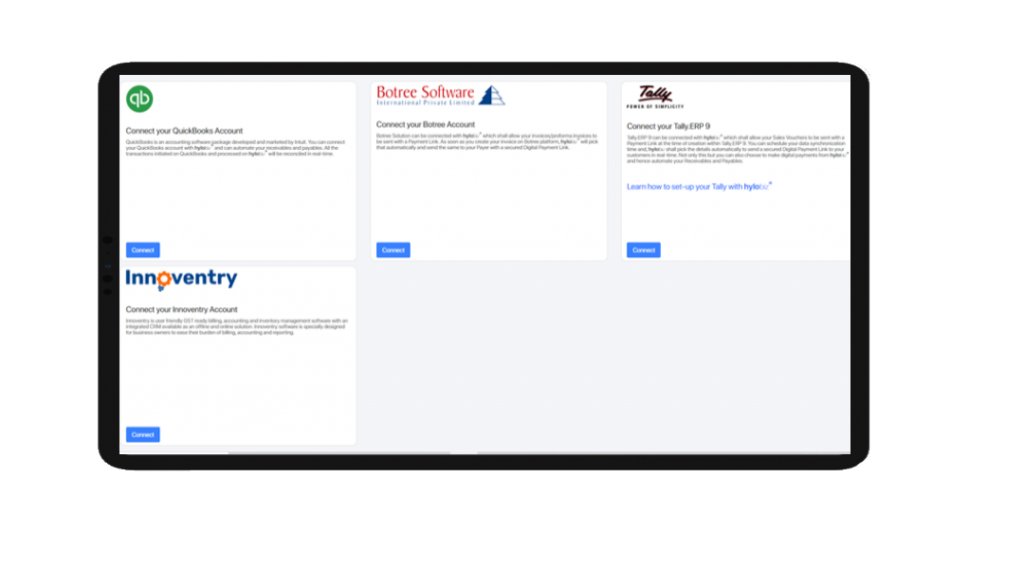

Working with multiple businesses can mean the usage of multiple ERPs, so by EOD whether you [as a small business owner] or your accounts team need to match and settle the records, upload in their respective ERPs to get a transparent view of receivables and payables.

What if I tell you, the ERPs could be integrated and auto-reconciliation can help you in reducing manual effort as well as eliminate human errors.

Even if you are using a single ERP and multiple banks accounts automated reconciliation can still help you for consolidating all your banking transactions. The platform also helps in exporting it in the report form of age-old debts, late-paying customers, and overall cash flow offering you full control of your payments and dues. So investing in one should be a good idea, as it helps in managing your finances better.

How Hylobiz Can Help

Hylobiz offers its customers, pre-integrated ERP to have full control and hassle-free communication with all your buyers

Auto-reconciliation for real-time cash-flow visibility

Reviewing your accounts and making sure they match your bank, credit card, or wallet statement is a nightmare task prone to manual error. And if the collection is in the form of “cash” it adds more to the misery.

But Automatic reconciliation assists businesses in organizing and speeding the processes for greater productivity.

How Hylobiz Can Help

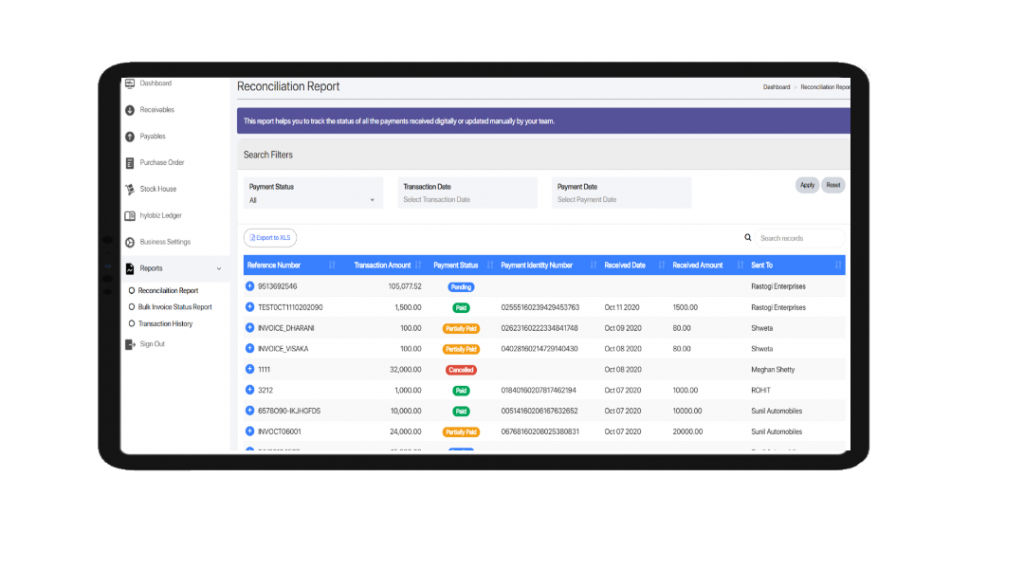

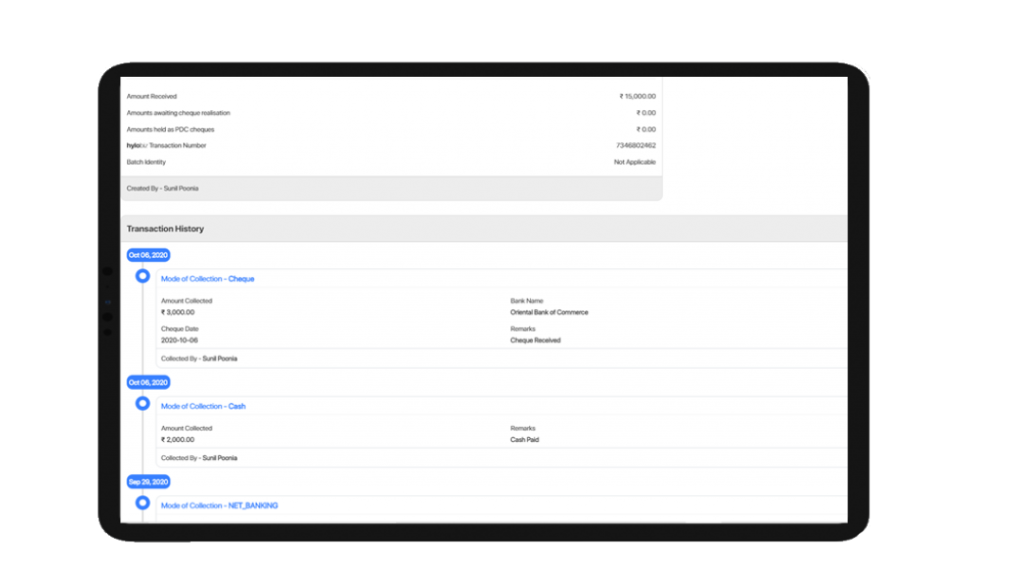

Hylobiz helps you with automated reconciliations of your banking transactions. All your receivables and payables are consolidated and updated in a single report with a Unique Number mapped to your transaction.

No matter if your payments are done in parts or full, the platform takes care of managing the audit trail of the transaction. The Reconciliation Report is accessible from anywhere, anytime. Any payment mode is recorded to ensure a transparent tracker and closure.

Get Real-time tracking of Payments with Digital Solutions

Tracking Payments is the biggest nightmare for SME’s. Be it with Cash/Cheque payments or online payments. Where is my money?

Digital platforms could be a life savior in such situations. Have you ever seen a teenager tracking his pizza delivery? It’s exciting, isn’t it? The same feature could be a great asset, reducing the worry of the SME’s. Knowing whether the money is with the bank or still with the buyer or with the collection agent can make your life easier. So lookout for a solution that can offer real-time tracking of payments and lessen your worries.

How Hylobiz Can Help

Hylobiz Payment Tracking feature allows its user to track the payments both digital, as well as cash and cheque payments collected by collection agents. While for online payment the status of the invoice gets updated to a partial/paid updating the dashboard, for Cash and Cheque payments, the account officer could mark it as Partial/Paid, and then it gets reflected on the Dashboard.

Automatic reminders for collections

Time is money, and if you are putting your “precious time” into calling your customers who are overdue or sending them messages, you are indeed losing on your business. But that doesn’t mean you shouldn’t be sending them reminders, a quick solution is to automate those reminders. Many digital platforms offer to send reminders to your customers for payments, so use them and use your precious time to expand your business.

How Hylobiz Can Help

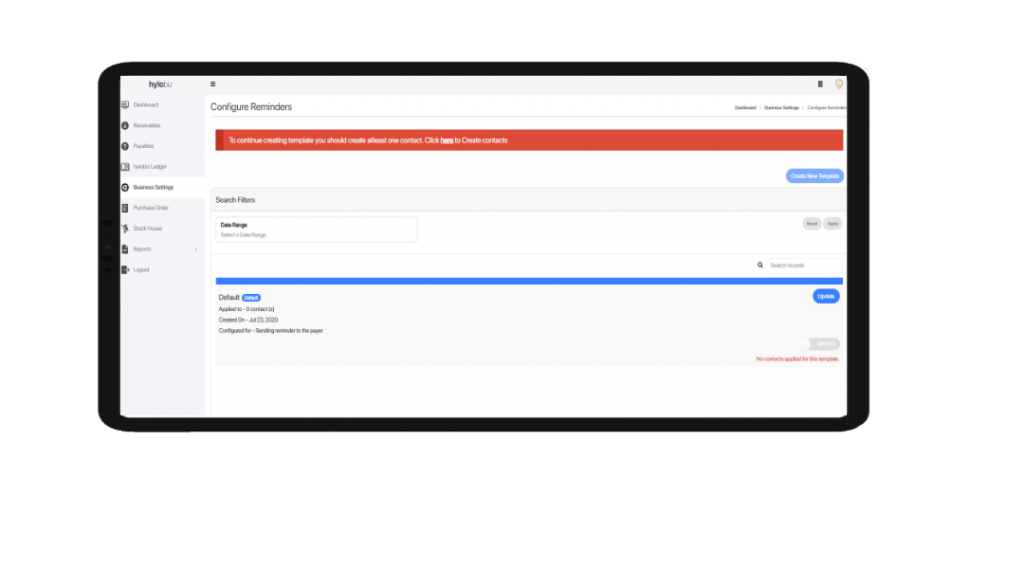

Hylobiz Automatic reminders offer its customers to bid goodbye to telephonic calls, WhatsApp messaging, SMSing, and emailing for your payments. Hylobiz gives you a powerful way to set your own rules for sending reminders and ensures to nudge your customers with overdue payments through SMS, Email, and WhatsApp.

You can also define your SMS and Email templates apart from choosing rules for each customer.

Hylobiz helps you save hours of manual chasing which you can focus on generating additional revenue.

It’s high time SME’s make a choice of getting paid on time and growing their business or stuck in the hassle of chasing invoices, and payments. By adopting an apt fintech solution you can shape your payments cycle transparent and on time.

We @Hylobiz can help you in “Getting paid on time”. If you are keen to know more, contact us here or sign up for a free trial here.