Did you know that Indian fintech market is one of the fastest growing fintech markets in the world? Out of more than 2000 fintechs in India, 67% was established in the last 5 years. As the adoption rate of fintechs in India is the highest among all the global players, it is expected that the Fintech market in India will grow to $84 Bn by 2025. (According to INVEST INDIA https://www.investindia.gov.in/sector/bfsi-fintech-financial-services).

Found this interesting?

Now the questions are

- Should banks/NBFCs and ERPs tie up with fintechs?

- How can these collaborations benefit the SME businesses?

Let’s deep dive.

First let us start with the importance of SME businesses in India and the need to support them.

SME – the principle driving force of Indian economy

The small and medium enterprises commonly known as SME are of paramount importance in India as the SME sector contribute to 1/3 of India’s GDP. Despite being a major economic contributor, the SMEs do not get access to easy capital and technology and in many cases crumble down.

Major challenges faced by SME businesses

- Insufficient funds

- Minimum access to capital due to absence of collateral to access credit

- Lack of awareness of technological and digital knowledge

- Minimum skilled resources to handle tedious accounting processes like ledger handling, maintaining balance sheet, managing reconciliations, managing invoices and so on.

- Lack of cash flow visibility

- Delay in payment and collection

- Difficult to track receivables and payables manually

- Inefficient business decisions arising out of unavailability of required insights

- Manual errors

- Manual chasing for invoices

The SMEs due to these challenges and due to recent pandemic are crippled and not able to rise to their full potential. The Government, financial technology companies (fintech), banks, NBFCs, corporates and technological companies are doing their bit to support the SMEs. SMEs mostly work in silos. Simultaneously handling multiple ERPs, users and accounts is not so easy. Hence, there is a need of combined expertise to support the small businesses and untap the potential of this sector.

Fintech – a fast growing superpower

The financial technology companies (fintech) automate financial system and offer endless array of services with the aid of innovative technology. Fintech is one of the fastest growing industries and is securing the future of the digital minded millennials both in retail and in business segments.

Why is there a need for banks/NBFCs to partner with fintech?

The traditional banks and NBFCs today can be assured that they need no longer look at fintech with an eye of suspicion, rather collaboration with these digitally and technologically innovative organizations is the answer to bridging the gap between offerings and customer expectations. Due to legacy system banks are not able to serve their SME customers to the fullest. They are now trying to find the ways to collaborate with fintech companies especially because the synergy

- Can reduce operational cost

- Can serve a wider customer base

- Can understand customer demands and serve them with wider range of personalized products and services

- Improve customer loyalty base through better customer relationship

- Enhances brand value

Online onboarding, e KYC, digital and cashflow based lending, revenue financing, and invoice discounting are some of the most cherished products serving the SME sector through these alliances. The huge data and experience of traditional financial institutions coupled with the technological expertise of fintech in a partnership can serve SME business customers better with advanced products and services at competitive pricing and can contribute to the development of the sector.

Suggested read: https://hylo.biz/how-bank-and-fintech-partnerships-work-in-2021/

Hylobiz is an SME focussed fintech and offers connected ERP and connected banking services, to simplify business processes and improve credit profile of SME businesses. Hylobiz is presently in partnership with top financial institutions like Bajaj Finserv, Neogrowth credit private limited , Kotak Mahindra Bank and YES Bank.

We offer financial institutions to collaborate. Banks/NBFCs click here to partner with us.

Why is ERP/ accounting platform need to associate with Fintech?

Though the configurable and advanced ERPs / business tools/ accounting platforms have all the top functional features to manage the accounting of an SME business, they are not all to serve them completely. In this rapid changing era of digital innovations, these ERPs when integrated with Fintech platforms, can support data storage, analysing data, and strategize business plan based on informed decisions. The integration can benefit in better tracking of payables and receivables and in maintaining financial details digitally and automatically.

Hylobiz is integrated with top ERP partners like Tally, Quickbooks, Zoho Books, CORALerp to name a few.

SME business can easily integrate their existing ERPs and accounts with Hylobiz platform in just few easy steps.

Suggested read: https://hylo.biz/how-connected-erp-accounting-software-can-revolutionize-sme-businesses/

Hylobiz- the secured ISO certified fintech start up and a neobank serving SMEs with the support of financial and ERP partners

Hylobiz in alliance with multiple banks and NBFCs aims at building a well-knit B2B value chain. All services on Hylobiz are offered online, so the system is paperless with everything being stored on cloud which can be accessed globally. Businesses customers can get visibility of real time cashflow.

Hylobiz is ISO 27001:2013 certified and assures security and privacy to its business customers through encrypted data, and secured hybrid structure.

The integration of ERPs and accounts with Hylobiz secured and automated platform, can enable SME customers

- to manage data with the support of cloud,

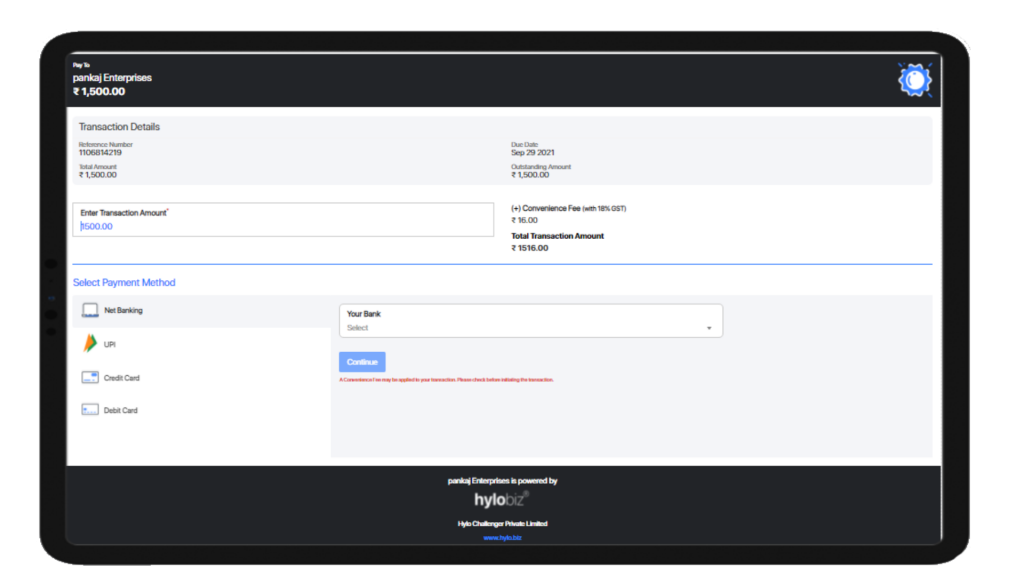

- create/ upload and send invoices and attach a secured payment link and send out to the right customer for payment collection over SMS, WhatsApp, Email and Hylobiz chat option. A static payment link can help collect a fixed amount repeatedly.

- manage and automate invoices and collections, can get paid through multiple modes like cash/cheque/Net Banking/ RTGS/ NEFT/ UPI.

- track and handle receivables and payables better,

- manage ledger digitally and share with their customers,

- get information and cyber security and

- access financial services

- automate vendor payments, pay out within due date in single/ bulk mode

- automate the management of invoices and inventories

- get access to quick settlement and automated reconciliations on real time

- Hylobiz chat option on our mobile app ensures better relationship with clients and helps to get paid and pay out without any delay

- get access to invoice discounting as the status of outstanding invoices/receivables (acting as collateral for loans) can be tracked though automated reconciliation and reports, realtime dashboard and business health score

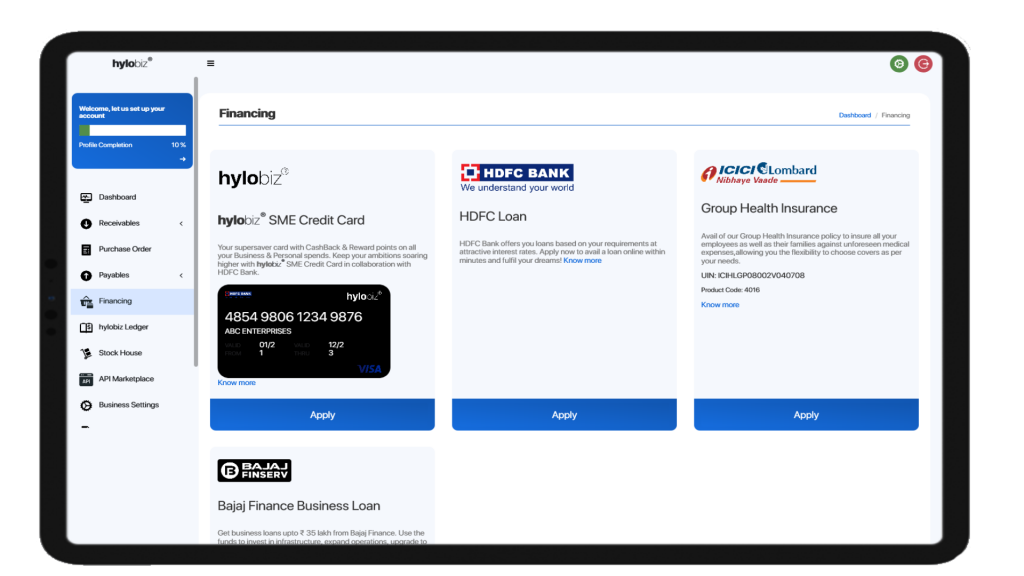

- the financial market place feature on the Hylobiz mobile app/ web portal gives access to collateral free business loans, pre-approved SME credit cards (with extended interest free credit period), insurances, e KYC and online bank account opening, savings, investments and insurances with our banking partners.

In our partnership with Kotak Mahindra Bank, SME businesses can access easy account opening. SME businesses through Hylobiz can get access to faster and cheaper working capital loans with Bajaj Finserv and Neogrowth credit private limited.

Businesses can Click here to avail loans from Bajaj Finserv

Hylobiz connects the business tools and processes with banking via open banking APIs and is a Neobanking platform serving SMEs.

We are live in UAE and India and are in a process to extend to other corridors. We would like to partner with more financial institutions and ERPs and would love to continue being the safe choice of SME businesses.

Reach us for further details at: support@hylo.biz.