UAE has undergone a transformation in the last decade. With an annual growth of 10%, government focus, and initiatives to create a diversified economy, Dubai is showcasing exponential growth in all sectors. Talking about the SMEs in UAE – they are the lifeline of the economy.

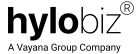

As per a report from SMEs in Dubai – SMEs account for 95% of establishments in Dubai.

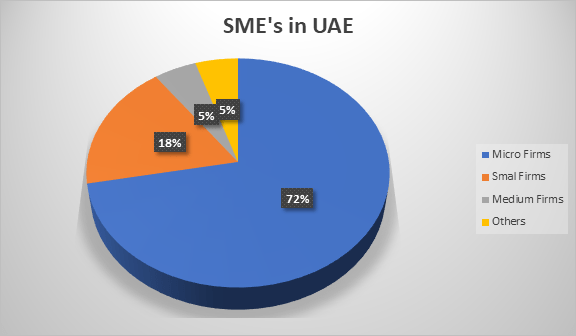

Definition of SMEs in UAE

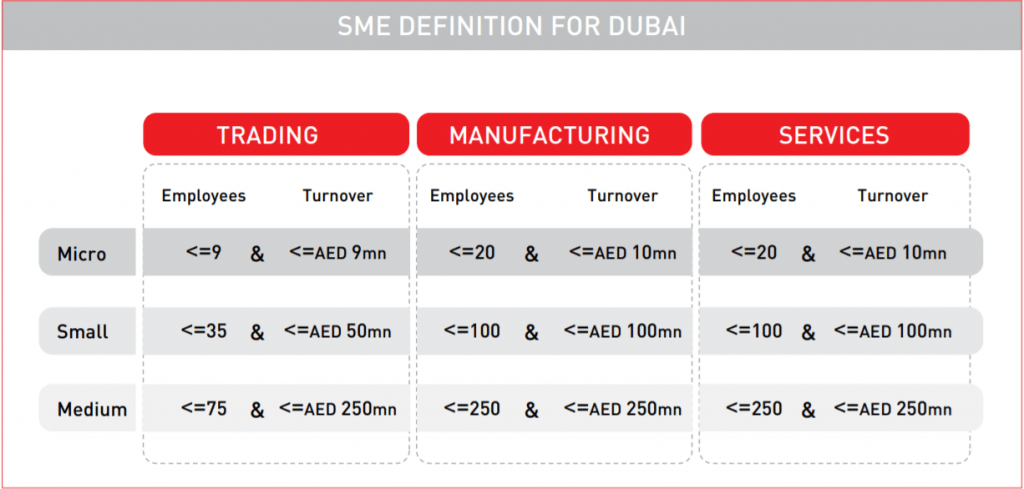

Key Sectors Focussed by SMEs in UAE

Manufacturing Sector

- Manufacturers of wearing apparel constitute a majority (33%)

- manufacturers of fabricated metal products 16%

Services Sector

- Firms providing Real Estate, Renting and Business Services account for a majority (33%)

- Construction & Contracting firms (at 27%

- Transportation and Telecommunications firms 17%

- Hotels and Restaurants sector 10%

Trading Sector

- Consumer Goods Trading,

- Textiles & Garments Trading,

- IT and Telecom Products Trading

- General Trading.

Pain Points of SME’s in UAE

A survey was conducted of 500 SMEs across the different sector and here are the key findings –

| International Orientation of SMEs i.e. revenues coming from regional and international markets |

High |

| Orientation towards Innovation among SMEs i.e. allocating the budget for conducting R&D and product development |

Low |

| IT Adoption among SMEs i.e. use of advanced IT systems (enterprise-level systems, such as ERP, CRM systems, etc.) within their business operations. |

Moderate |

| Focus on Human Capital Development by SMEs i.e. an HR department/resource, HR policies and evaluation based on KPIs |

Moderate |

| Access to Finance for SMEs i.e. reasons to access financing option, types of financing options and accessibility to commence and expand business |

Moderate |

| Scalability Potential of SMEs i.e. assets and resources optimization or setting up the expectation of annual growth |

Low |

| Orientation towards Corporate Governance among SMEs i.e. maintaining a formal organizational structure, adhering to the Corporate governance principle and financial audits |

Low |

If we browse through the report, the Medium and Small firm categories are majorly able to invest and grow in all of the above areas across all sectors. The Micro firms in each sector have a low contribution to technology adoption, international adoption or scalability, or even access to Finance. Sample these –

So what could be done to target such mass that is responsible for the immense growth of a country?

I feel the answer is a NEO BANK!

A digital-only bank that caters to the need of SMEs and assists, SMEs in UAE and Micro firms in automating their receivables, payables, and most importantly a Single platform with aggregated account information.

Let’s explore Neo Banking in UAE use cases

Neo banking in UAE for SMEs

SMEs are export-oriented in UAE and a Neo Bank could help them in

A Neo bank could boost export-oriented firms with Single platform offering account information and also taking care of compliance issues. Take for example Hylo Neo Bank –

Scenario – A UAE exporter is sending apparel to an Indian Importer.

- Indian Importer raises a Purchase Order of apparels via Hylo Neo bank

- The UAE exporter would receive the PO and creates an invoice for the same via Hylo

- The invoice is received by the Indian importer, and the consignment is dispatched by the UAE exporter.

- The payments as per the rules set are released and could be tracked using Hylo.

What a Neo Bank Offers –

- Single platform for multiple parties

- Account integration

- Payment tracking and real-time updates.

SMEs in UAE like to Innovate and Neo Bank could help SMEs in innovation

With a Neo Bank, innovation could be just a matter of a few clicks. An SME would like to innovate with newer products, enhancements of products/services, process improvements, or delivery enhancements. Neo Banking could assist an SME in all of these. Sample this –

A UAE SME of Manufacturing is looking to target Dubai Shopping Festival and wants details of all its retailers in Dubai as what were the major percentage of apparel that was sold last year.

Adding a Data Analytic report with a Neo Bank solution could aid in getting a clear insight into the invoices and PO created/received. The analytics report could also trace the kind of trend observed in the current year with all your retailers. You could use this report to present facts to your retailers on “trends” observed all year round and suggest similar apparel that would reign the upcoming festival making your business partner’s life easier.

Using Neo Banking services like Hylo could also help in process improvements like inventory management and boosting your working capital efficiency.

SMEs in UAE are keen on “Accessing Finance” and Neo Banking could be the service they are looking for.

As the matter of fact is that any business to grow and sustain needs finance. While most of the business happens on a “credit” basis SME financing via loans could be a vital source of capital and Neo Banking can assist an SME in accessing various options of SME loans.

The report states that 96% of SMEs in UAE depend primarily on their personal funds/borrowing from friends/families to expand or support their businesses. Another report Access to Credit for SMEs’ indicator of the IMD’s ‘World Competitiveness Framework (2018) ranks Dubai 44 out of 64 countries in terms of their ease of to access finance.

The above facts highlight a need for quick and easy access to finance the SMEs, in the form of long or short-term financing to manage their capital expansion plan and a Neo Bank is a perfect fit!

A Neo Bank that either work in collaboration with a Bank or is itself licensed to be a bank can provide quick and easy loans to the SMEs in UAE opening the possibilities for business expansion and growth.

If you are an SME and looking to expand, grow or innovate Hylo can help you! We are an SME Neo bank! Just contact us here