The article talks about How Hylobiz as an idea evolved in just few months, the thought process involved in shaping the product, the feedback from the industry leaders to improve and make the right-fit for the SME’s. The Part three that talks about Pricing model and establishing Hylobiz as a brand. If you have missed Part one that narrated the inception, identifying the pain points and market space, you can read here. And Part two narrates the crafting of product experience , you can read here.

Hylobiz Pricing – A big NO to the freemium model

While many businesses offer a freemium model to start the business and follow the word of mouth approach, we strongly believe, that if we are adding value to SMEs business and taking their pain away, we deserve to be paid for our efforts.

Our goto market strategy has been top-down in the value chain, with a core focus on receivables. For the first 10K SMEs on platform, Hylobiz acquired them directly and through digital reach, while signing partnerships with banks and ERP/CRM companies to build strong channel partnerships to reach next million SMEs through the alliances.

We have gone through the product-market fitment and price discovery journey and basis that below are the revenue streams that we are already realizing.

| SME Type | Monetization |

| Turnover more than 100 crores per annum INR | Setup cost + SaaS Fee / Month + Transactional fee |

| Turnover 10-100 crore per annum INR | SaaS Fee / Month + Transactional fee |

| Turnover below 10 crores per annum INR | Transactional fee |

The secondary monetization streams that has been our focus is offering of financial/non-financial services through the partner banks where we would generate revenues by extending the products over the network.

HYLOBIZ is at the early stage of adoption as well as revenue generation which hasn’t been so common for startups to be generating revenues. As of now we are at MRR 1500 USD within the 5 months of formal launch in India, while we went live in UAE on April 23rd 2020. We aim to hit a 50K USD MRR by end of the year.

Hylobiz goes Global

SME’s in any nation face the same issue and hence our idea had always been to expand outside India. We made our global presence by going live in UAE on April 23rd 2020 and very soon we would be live in Bahrain, with a plan to expand into MENA markets through channel partners/alliances.

We got into partnership with one of the largest telco brand Etisalat in UAE. HYLOBIZ has signed a SaaS partnership agreement with Etisalat, getting immediate access to 280K SMEs on Etisalat network, who can be targeted for HYLOBIZ offering.

We also collaborated with the PRISM group in UAE and partnered with Noon Bank as our payment gateway.

Branding of HyloBiz

Reaching out to customers is the most crucial part of any product launch says Lakshmi Thampi, co-founder and Digital Strategist @Hylobiz. Initially, our product was being assumed as an overlapping offering with the ERP platforms, and we had to get our pitch and content right. Our solution works in collaboration with any ERP or accounting system. Our biggest challenge was to adopt the right words and pitch HYLOBIZ’s USP to have our SMEs see through the value proposition says Lakshmi Thampi.

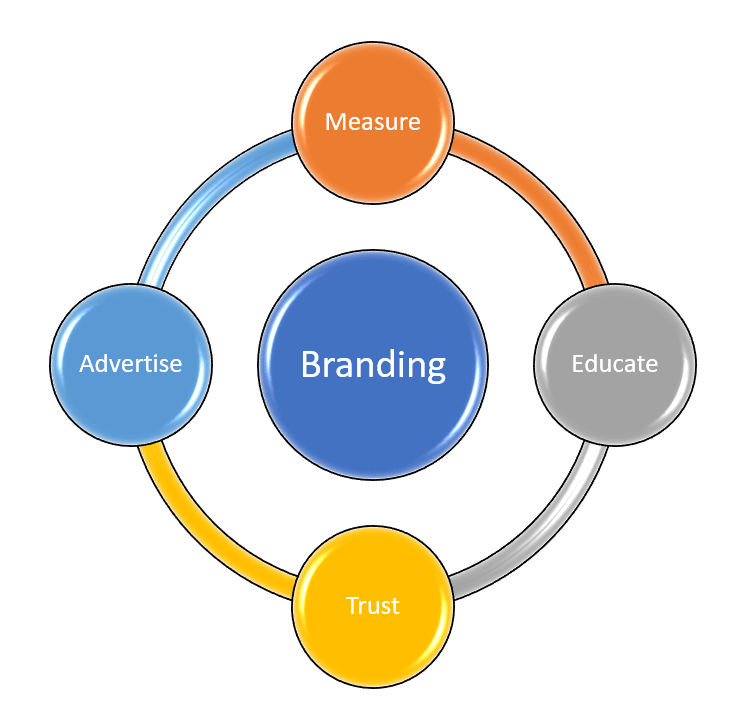

We divided our Branding process into four crucial steps –

We targeted to educate our SME via Blog posts, and videos that can be accessed via Mobile and Desktop. Our user base is from varied background, they are mix of urban and rural individuals, tech geeks and not a big fan of technology. We have to look for ways from paper to digital to get their attention. To explain what our product is capable of and although there is a lot to explore… we have started getting traction on our website and social media followers.

The next step was to “build trust” and that cannot be executed unless you get into collaboration/partnership. Once the two parties exchange synergies, both party know how things work, trust get established. But we realized, when a person hears “good things” about a person/product, he is somehow inclined to at least try it out. And that’s where we started working with our partners to speak out in public about What Hylobiz is and how it helped them. And we started getting some inquiries on our chat and social media pages.

The use of FB , Instagram and Google ads have assisted us in targeting the “right customers”. We used to run our ads in a planned manner with an overlap of new feature releases or upcoming Youtube/FB live sessions.

Last and not least was measuring our activities and traction it had gained. As Lakshmi quotes – To be honest it’s just nine months of the activity and our tractions may not be “high enough” but we are getting queries on daily basis, our followers are increasing, our posts are being reshared and getting the love from the community. We make sure to have a monthly analysis of our actions and tweak our strategy by focussing on what works and what could be deprioritized.

The Future of Hylobiz

Rajat Bansal @ Strive – coined the name “Network of Ledgers” for us which gave us even stronger positioning for being the only business connecting into SME’s businesses that deep with all their legacy tools at one end and all their financial services needs on the other side.

We are in process of launching Network of Ledgers [ a big thanks to Rajat for coining this word], to understand it better let’s pick an example – Advait Lifestyle Agency from Kerala who is the regional distributor of Cosmetic products have 12 distributors in every district. The system that they used to maintain data and leads was Microsoft Dynamics. But moving down the supply chain, these 12 distributors for their communication with their retailers and wholesalers may/may not necessarily use Microsoft Dynamics as each tool has its own limitations in terms of permissible workload, available resources, pricing structure and time liberties.

One can visualize Hylobiz as Cloud with intelligent nodes connecting different ERP’s easing SME’s pain of record-keeping and offering transparency.

This multiple system maintenance is another “workload” for an SME who at each end of the day looks to reconcile his transactions, matches the inventory, and raises invoices. Being an SME what should be his focus? Focussing on sales, business opportunities, employee satisfaction or record keeping?

That’s where Hylobiz pitches in!

With this, we end our Part-three of our journey. But we are sure, there is more to share in coming days. As good things take some time to shape up. ! So stay tuned.

Hylobiz evolved to assist every business in availing Business Banking services that help them in collecting money faster, digitizing their transactions and avail automation using our Network of ledgers feature. To know more about us, please contact us here and if you are keen in exploring unique features of Hylobiz, register here for a free trial.

How Hylobiz has reduced payment delays, read our case study here