The article talks about How Hylobiz as an idea evolved in just a few months, the thought process involved in shaping the product, and the feedback from the industry leaders to improve and make the right fit for the SMEs. This is Part one that covers the inception, identifying the pain points and market space. Part two would talk about crafting the product experience and value-driven growth.

Key in “Delayed payments” or “SME’s pain points” on any of the search engines and there are millions of articles with the never-ending list of challenges faced by an SME across the globe. Manual generation of invoices, shipping of invoices, PIs, and POs with near-zero traceability, manual reminders to the customers as the majority of b2b transactions happen on credit. As the dues are cleared against the invoices, the reconciliation for the incoming payments on multiple channels and part payments is another nightmare faced by an enterprise.

The larger share of the collection is physical globally, slowly going digital and EOD reconciliation is still a cumbersome job, involving at least days to weeks of exercise to reconcile books. The invoices raised in the system could stay in “unpaid” status for as long as 90 days. While medium-sized enterprises could still dip in their cash reserves, small and micro struggle hard to meet their personal and business needs.

As our Founder, Vishal Gupta recalls the initial days of brainstorming with potential investors, friends, and family, the statement that struck the chord was by one of the VCs “build the pain killer, more like a “Saridon”, not the multivitamin tablet. An analogy is shaped up the product for a real need on the ground for default adoption and not as a “nice to have” offering. It gave me clarity to stay focussed on receivables and payables within the b2b value chain.

With multiple challenges that the SMEs face within the b2b distribution value chain, Hylobiz picked up the key pain areas based on the market feedback, and product iteration with early users and investors.

Hylobiz would be happy to assist an SME with the automation of payables and receivables.

Contact us now here

Using the primary transactions data,

For these products coming from the banking partners in the HYLOBIZ platform, SMEs will have a choice to pick the best for their needs.

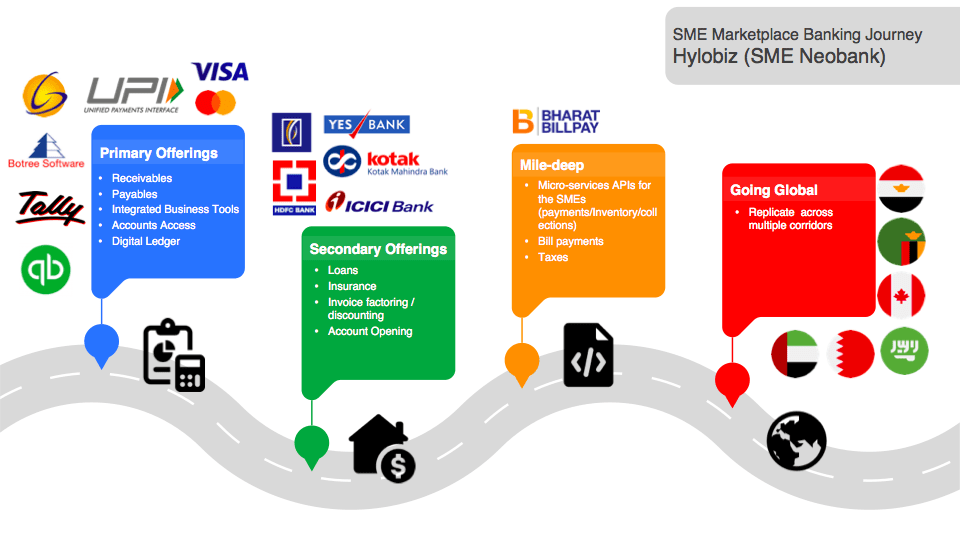

Hylobiz started as its primary offerings of payables/receivables is building a global Neobank (marketplace banking Engine) for the SMEs globally

This digital footprint of data once built would provide an in-depth secondary sales view to the brands too.

Hylobiz is just a year old and if we look at the number of transactions and invoices from August 2019 we started with 70 transactions and by March 2020 we had processed ~12000 transactions in India of value worth 20 crores. Onboarding of SMEs has been growing with ~35 distributors opening the access to approx. 2500 SMEs at their next level, using Hylobiz. From a GTM perspective, Hylobiz chose to go for direct acquisition for the first few hundred distributors, each of them, in turn, provides access to +/- 200 sub-distributors/dealers (SMEs) at the next level. Hence the receivables digitization with a top-down acquisition strategy helped Hylobiz to keep the cost of customer acquisition marginal in this challenging segment.

Another quote by Ajay Nemani @ FF21, one of our early adopters and investors loves to give this analogy of “Ant and Elephant” when we get into the discussion of HYLOBIZ and some big names who can potentially come in the b2b space. He constantly reminds me by saying that HYLOBIZ is an ant size business serving millions of similar businesses with specific needs on their legacy tools integrations which an elephant would have its own challenges to get into.

With our beta rollout, within the first six months of growth, we collaborated with leading Banks in India – HDFC Bank, ICICI Bank, and YES BANK are the top names catering to the lion’s share of the HYLO’s SME TAM. (Target Addressable market). Hylobiz is already integrated with these banks while a few more leading banks like RBL Bank, Kotak Mahindra Bank, Axis, Indus, Ujjivan SFB are at different stages of integrations/agreements falling in place.

Being trusted by branded partners, surely boost your confidence that you are in the right direction. And then came two shiny awards, one from the Karnataka government as a Karnataka startup of the year 2020.

And at HDFC Bank’s API Banking Summit Hylobiz was applauded for being an innovative solution.

While we started as a bootstrapped infusing 250K USD, we raised an Angel round of 500K USD from some marquee angel investors in the US (Google, Juniper) and in India (Ex Myntra, Multiply Ventures, FF21).

As Vishal Gupta states – I give a lot of credit to our friends and investors who not only have been appreciative of the idea but have also helped us with critical – constructive feedback towards keeping a sharp focus on product-market, GTM, and monetization aspects.

Hylobiz is driven by a founding team from a varied background that helped us in delivering a solution completely focused on SMEs. Vishal Gupta comes with a decade of fintech startup experience that aided to provide the right direction to the product fixing its aim on “what needs to be solved”.

Anurag Rastogi a fintech product expert is the backbone of the star product having worked with Vishal across the three fintech startups that they have done together

Ashish Mahal an ex-banker and passionate fintech enthusiast drove the product pricing and sales strategy, he made sure that the solution is value-driven, which can help in generating revenues for the firm. Lakshmi Thampi, the digital market strategist and growth hacker who shaped the branding and positioning of the product on the web.

So, what has Hylobiz done to stack the odds so monumentally in the favor of growth? We’ll look at what we did early on to set the stage for success, including:

- Defining market space and identifying customer’s pain points

- Nailing the product experience by focusing on doing a few things exceptionally well

- A big NO to the freemium model that has helped us in offering a “Value-driven solution”

Defining Market Space and identifying pain points

Define your customer clearly and the product has to focus on his/her needs. Like we figured that the owner of the SME business is our go-to customer, not his accountant or staff.

– Raveen Sastry @ Multiple Ventures

We were not the first business that was targeting SME’s and many such tools existed in the form of ERP and accounting software. In fact in India Tally is the most widely ERP used amongst SMEs, B2B, and enterprises, so the digitization existed but yet delays in payments, and pending invoices due to process issues were some of the nightmares of SMEs’ lives.

After our research, interviews, and surveys we identified the problem –

- Multiple tools / invoicing / Accounting platforms and ERPs are used across the distribution value chain and there is no common connection between the ledgers other than having humans extract, ship, and enter data manually amongst the varied engines.

- The accounting professional spends daily 2-3 hrs to reconciling the account and settling them on each system

- SMEs struggle to gain visibility with multiple stakeholders involved and dues pending. Account statement / Ledger between the seller/buyer is a constant ask leading to delays.

- 60-70% payment collection is yet via cheque or cash where many times the representative does not turn up after the collection or the party defers saying they have made the payment. Massive leakages and delays hurt the working capital cycle of the SMEs

- The use of legacy tools, processes, and systems that are used by SMEs cannot be replaced but the SMEs are keen to adapt to new innovation, by simple integration with the HyloBiz Open API banking platform that serves as a “network of ledgers” as well as seamless connectivity into their preferred banks.

With these major findings, we listed our features –

- Receivables and Payables digitization end to end

- Integrations with top SMEs tools with significant market share

- Integrations with top SME focused banking institutions

- HYLOBIZ to be the single source of business-banking management for the SME Owner.

And that’s when Hylobiz was born.

Talking about “the birth of Hylobiz”, Vishal Gupta narrates – that the HYLOBIZ team has been in the fintech space and addressing the digital transformation use cases for small and medium-size financial institutions across India, South and Middle East Asia, Africa, and Europe. Having addressed many transaction sets and use cases around b2c space for student banking, immigrants, agriculture, diaspora banking, etc, our partner banks across all these markets kept on asking for the SME (b2b transactions) value chain digitization. We gathered the SME value chain-related gaps across the various markets as listed above and picked Receivables | Payables | Credit Access as our core transactions to go after. With the Segment being very clearly defined as the SME distribution value chain and transaction sets being Receivables/payables we started building the solution in India. Again our vision was very clear that we will build the solution in India, India given India being one of the most advanced financial infrastructures, and take it to the global rollout. As I write this today, we are living in India and UAE with a clear focus to build a solid foundation in India and MENA markets over the next 2-3 years.

On a similar note Ashish Mahal, Co-founder of hylobiz, working from UAE says – Being an SME owner myself and having grown up among family members in trading businesses in UAE, I have seen common struggles around collections and cash flows. This is where HyloBiz struck a chord when Vishal discussed the whole concept with me.

SMEs are the lifeline of the economy and yet they do not have access to the formal credit system, face cash crunch most often due to delayed or late payments, and need to take risky measures in case they are expanding their business.

So far Hylobiz’s growth has primarily been driven through “showcasing the value a product could bring in the market that wasn’t really there”. Just imagine if a SME1 could get his payments within ten days of the invoice date when compared to another SME2 whose payment cycle ranges from 20 days to 70 days. Whose business can expand and grow?

Our product is a transformation in the SME market! We are selling innovation and just not the product. We want to ease out SME pain of offering transparency in payments.

We want businesses to focus on expansion and growth rather than putting energy into chasing brands to release payments. We consider “Timely Payments as SME’s business right”.

Act now, and get on-time payment with Hylobiz. Contact us here

We are selling a connected system that assists the lifeline of any nation to upload an invoice [against the purchase order], send the payment link via email/SMS and the buyer can instantly make the payment. In case of physical collection via Cash/Cheque we are offering tracking so as to provide transparency

Part two of the article would cover the journey of crafting the best product experience and how we targeted value-driven growth for Hylobiz. Stay tuned.

How Hylobiz has reduced payment delays, read our case study here