How do businesses ensure that they get paid on time?

By creating Invoices on time!

Invoices are a crucial part of every business transaction since they serve as proof of the supply agree upon between the buyer and the seller. The availability of data on sales volume, shipping date, price, and discounts creates transparency.

However, it was discovered that the procedure lacked sufficient transparency and that it was easy to manipulate invoices, which restricted business growth and malfunctioning business transactions.

In order to address the problems brought on by fake invoices and invoice fraud, the Indian government has established e Invoicing under GST for all B2B transactions carried out by a seller.

E-invoice was made applicable for businesses with an aggregate turnover of 20 crores from 1st April 2022.

Let’s learn more about e-invoices and the most recent developments in this blog.

Benefits of GST e-Invoicing

- Promotes Standardization.

- Automatic Notification.

- Removes False Invoices from the System.

- Decrease in Errors.

- Better Payment Collections.

- Increase in Invoice Discounts.

- Boost Overall Effectiveness.

From 1st October 2022, CBIC has made GST E-invoicing mandatory for those having an annual turnover of more than 10 crores. Notification No. 17 / 2022 / CT dated 1- Aug-2022 specified the above limit.

There are severe repercussions for failing to generate e-invoices, in addition to cash flow problems, reputational damage, and a penalty from the government.

Subrules (4), (5), and (6) of CGST Rule 48 explain the e-invoice requirements. It only applies to particular taxpayers who provide taxable goods and services and satisfy the requirements for annual aggregate turnover. The remaining taxpayers are consequently required to comply with the standard tax invoice rules.

What are Invalid Invoices?

- The e invoicing created does not follow the government’s mandated format requirements or the standard invoice structure.

- The created invoice is a duplicate of an earlier invoice against which IRN was generated.

- The supplier’s or the recipient’s GSTIN is invalid or inactive.

Penalty for not Generating Invoices:

- E-invoice penalties apply when an GST e-Invoicing is issued improperly or not at all in accordance with GST. With each invoice, there is a penalty of 100% of the tax owed or Rs. 10,000, whichever is more.

- Rs. 25,000 per invoice is the fine for inappropriate invoices.

Looking for a Secure way to Produce e-Invoices:

Well, no need to look anymore! Introducing Hylobiz

Hylobiz is a B2B fintech, offering trustworthy and efficient electronic invoicing solutions to businesses. Your collection, payouts, payment reminders, and credit criteria are all automated in addition to electronic invoicing. Making your company compliant with e-invoicing using Hylobiz encourages the growth of SME businesses.

Benefits of Generating e-Invoicing with Hylobiz

- Connect your ERP

Without requiring any process changes, you can quickly link your current ERP on Hylobiz and automate your business invoicing and collections. - Lowest Setup Period

With Hylobiz, you can quickly and easily upload invoices, create invoices, or integrate your invoicing system. - Zero Downtime

You might need to make an e invoicing at all times. We know your business needs and work to ensure that our system is always available to you. The largest GSP in India is Vayana, which attests to that. - Digital and Automatic Reconciliation

Get a digital ledger that supports auto-reconciliation into your ERP for all transactions. Your business relationship will be better since your customers and suppliers can access our digital ledger. - Connected Banking

With our convenient connected banking services, we assist you in greatly increasing your business’s collections and payouts. On our platform, we currently support YES Bank, Kotak Mahindra Bank, and Axis Bank. - Offering Full Support

Get 24/7 technical support from our team.

The Latest Updates on e Invoicing are Valid from 1st October 2022

- Further reductions to the limit are likely as of 1 April 2023, to Rs. 5 cr. Despite the fact that no notification has been sent.

- In the future, the government wants e-invoices to be required for B2B and export transactions, except for those who are in the composition scheme.

Conclusion:

We are not just invoice management software, instead, we can call it an all-in-one automated solution that simplifies your work effort and increases efficiency for the business.

Share your invoices with attached payment links, which are safe and secure multiple-layer encryption.

By simply uploading your invoice data, we make it simple for you to generate e-invoices and e way bills in compliance with government-notified requirements.

Utilize our platform, which is ISO-certified, to access connected banking services with our financial partners. With connected banking, you may use Hylobiz to manage your payments and collections while increasing your ROI.

Book a demo today: https://hylo.biz/book-demo/

Suggested read: https://hylo.biz/what-is-e-invoicing-under-gst/

Read more of our blogs: https://hylo.biz/blogs/

In case of any query, reach out to us: support@hylobiz.com

Frequently Asked Questions

What do we mean by GST e-Invoicing?

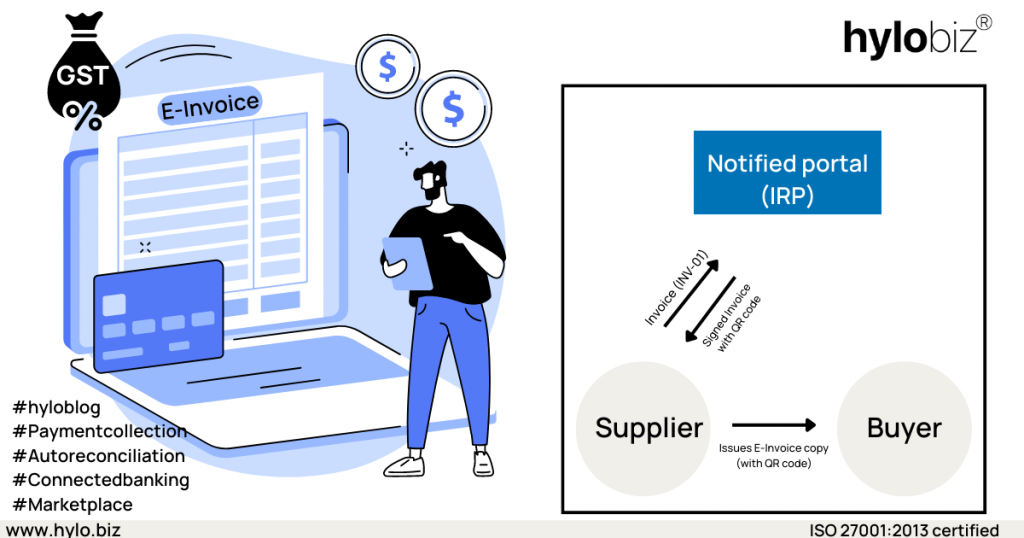

An e-invoice or an electronic invoice is a digital document exchanged between a supplier and buyer that is validated by the government tax portal. In the GST e-invoicing system, B2B invoices are digitally prepared in a specific e-invoicing format and authenticated by the Goods and Services Tax Network (GSTN). This system ensures that all businesses use the same format when reporting invoices to the GST portal.

What is the new GST e invoicing limit?

The GST einvoice limit is set by the GOI and applies to all businesses registered under GST. It helps businesses keep track of their transactions and ensure that they are compliant with GST regulations. From 1st October 2022, einvoicing is mandatory for all businesses whose aggregate turnover has exceeded Rs 20 crore in any of the previous financial years.

What is the default period for GST e invoice?

There is no time limit or period in which an invoice must be generated. It is recommended, to create an e-invoice on or after the invoice date but before filing GSTR-1 returns

How do I generate Einvoice in GST?

To register for the einvoice portal, go to https://einvoice1.gst.gov.in/Home/UserRegistration.

However, B2B businesses can easily generate GST invoices on Hylobiz!

• Sync invoices from your current ERP or create a new invoice in Hylobiz.

• Quickly create einvoices from digital invoices.

• Your e-invoice with IRN and QR code will appear on your screen and in your email.

You can also get paid on time by sending einvoices via email, WhatsApp, SMS, and other channels.