With the world constantly evolving, there is a need for constant evolution in our general ecosystem as well. Digital Age isn’t a thing of today! It isn’t something that happened at a button click. Our evolution from doing everything manually to automating basic things has taken its due course of time. On the same lines from roadside markets to mega-malls, and e-commerce…cash is changing lesser hands as we digitize most of our payments today. For you, me, and everyone out there, time is no more leisure. So, as a species that is constantly evolving the ways to live and thrive…we have moved ahead to explore safer, faster, and more convenient ways to make our monetary transactions.

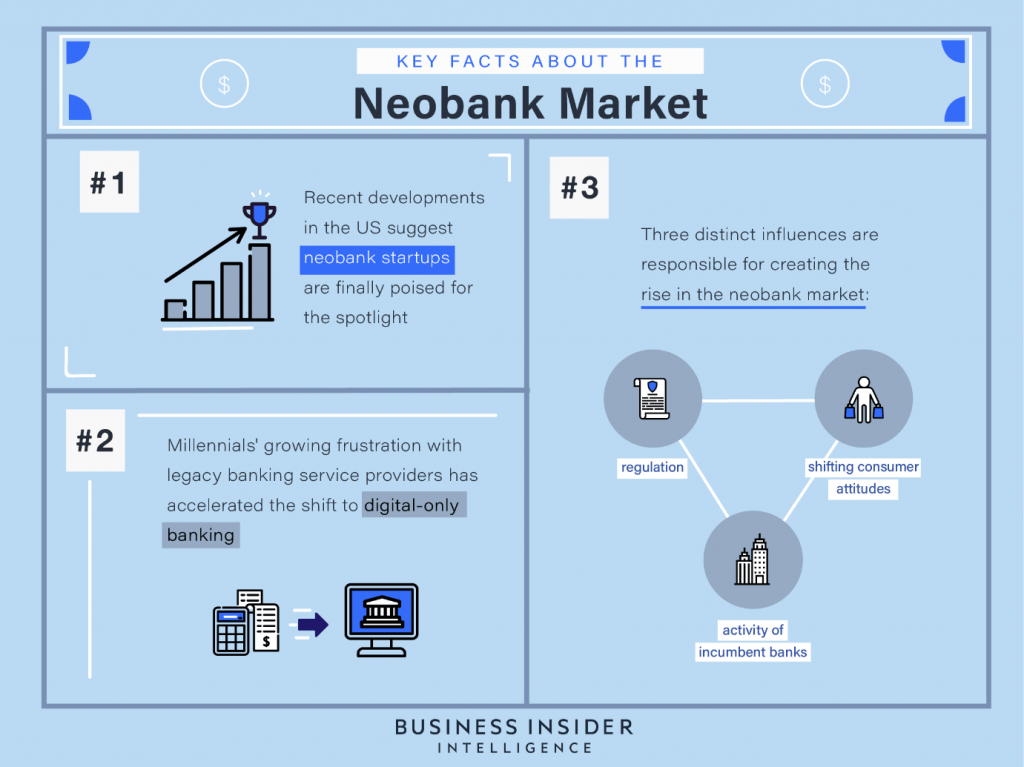

Gaps in the Traditional Banking structure are the key drivers of Neo Banking.

The ‘Neo’ Placement

Hello Neo Banking!

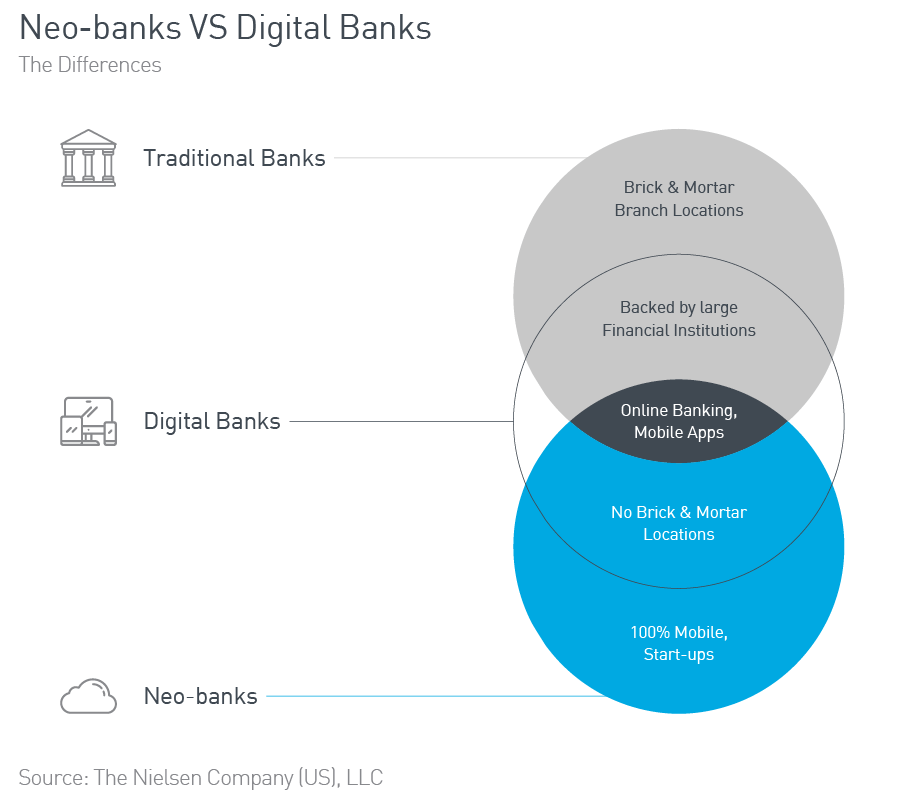

‘Neo Banking’ are the banks of today, which we carry along in our pockets. These are 100% digital banks, having no brick and mortar presence… available on your smartphones, extending 24*7 service and support. This technology-driven bank drives and thrives on machine learning and includes facets of artificial intelligence for enhanced customer experience on various fronts. While they have a traditional bank behind them, they do not have a banking license themselves.

Today, there is no need to fill that bank slip and stand in a long queue to withdraw cash from our banks. Leave aside taking a long drive to the far end of this city… just to make the long-pending payment to your vendor. Look at the overheads you bear through these traditional methods. The time, effort, and expense…all lost. Through Neo Banking you have the privilege to be able to choose your own moment of transaction. In addition to leveraging value-added benefits like staying updated on key business indicators, features to monitor invoicing status, inventory levels, access relevant documents, design reports, and so much more. Real-time monitoring of your key business indicators is a power to leverage right now! What’s ‘Newer’ with Neo Banking is that you get to enjoy user-friendly interfaces, service support through Artificial Intelligence, and extended benefits like faster account opening, immediate payments, opportunities for mobile deposits, cryptocurrencies, P2P payments amongst other features.

A ‘Neo’ Knock at the GCC

Neo Banking has successfully carved a place for itself and is in a phase of constant expansion across different geographies. Once known for adopting the ‘Cash is King’ approach, the GCC region is not untouched by this digital revolution in the banking sector.

| According to a recent study from the Federal Competitiveness and Statistics Authority, 90 percent of people in the UAE use digital banking, while the number of ATM users reached 100 percent. Samer Soliman, managing director, Middle East, Network International, said digital payments are set to grow from $6.5 trillion in 2017 to $8.9trn in 2022. Read more here |

| Read here about a recent Visa and DED survey across the UAE about the security of digital payments, both in-store and online. According to the survey findings, UAE consumers are increasingly comfortable paying and transacting with cards overall (in-store and online), with 84% of respondents finding cards more secure than cash. Among online shoppers, specifically, 73% prefer paying by card driven by factors such as security (73%), budget management (58%), and spending rewards (52%). 87% of the respondents claimed to have started making more card payments online in the past two years. The survey findings also noted that 82% of respondents trust digital wallets (contactless transactions with mobile) and 75% trust contactless cards. |

A ‘Neo’ Welcoming Ecosystem at the GCC

With an expanding percentage of the millennial population, the region is witnessing a multi-fold rise in the popularity and demand for Neo Banking solutions.

Some estimates suggest that investments in Gulf-based FinTech startups are expected to reach $2 billion in the next decade, compared to $150 million invested in the last 10 years. (Source: GoMedici.com)

Established Traditional Banks and Fintech companies have begun to understand and accept the disruptor. They are now Integrating their services and offering customized banking experiences to the end-user.

To a recent report submitted by Strategy&, Until now, the Gulf Cooperation Council (GCC) countries have not established particularly deep FinTech ecosystems. However, that could soon change because the four key design elements necessary for FinTech ecosystems are present in the GCC. These are the business environment/access to markets, government/ regulatory support, access to capital, and financial expertise. Read more here

PWC also offers an insight into the driving factors for Fintech’s success in the GCC

| 1 | The strong position and influence of the government in the economic development of the GCC eases the setup and organization of the FinTech ecosystems at an early stage |

| 2 | Business environment/ Access to markets – A dynamic technology startup community works on cutting-edge digital developments that are “tailored” to the Middle East (e.g., Arabic needs, culture, and language. Thanks to its cosmopolitan nature, in regards to both its talent pool and presence of international enterprises, the GCC is very attractive to regional and international talent |

| 3 | Access to capital – Government-driven funding programs (e.g., Hamdan Innovation Incubator, SeedStartup, In5), venture capitalists, and local financial services players can provide early-stage funding for FinTech startups |

| 4 | Financial expertise – In line with access to capital, various government bodies and international and local financial institutions can provide the needed advisory, due diligence, and lobbying services to seed ecosystem setup. (Source: Strategy&) |

Meet the ‘Neo’ Disruptors of the GCC

Bahrain Bank ABC in the first breakthrough of its kind has successfully introduced Fatema to the region. Created by Soul Machines, a New Zealand-based company, Fatema is an emotionally-intelligent digital employee of the bank. Bolstered by Artificial Intelligence and cutting-edge digital neurology it engages with the customers and resolves their queries. It responds to facial expressions and successfully engages with the customer’s basis the emotions. Bringing in expression and character to a bot is a giant leap for the bank and the customers are responding positively.

In another significant move, Bahrain’s Bank ABC has also launched its own Neo Banking offering, which is completely independent of the bank. For customized and smarter business offerings they have entered into a strategic partnership with Jumio. Together, they have come out to offer an AI-powered identity scanner that makes it the first bank in the Middle East to have employed a biometric enabled KYC system.

We also have the Emirates NBD’s Liv. having launched a lifestyle digital bank for millennials with innovation support from global payments innovation service Verrency. This multi-year partnership will allow Emirates NBD to avail of Verrency’s cloud-based payments innovation service for various value-added service offerings to its customers. Emirates NBD’s Liv. in the initial three years of its inception has been enjoying great followership from the target customer base, the ‘millennials’. It became the region’s fastest-growing bank by adding over 1,00,000 new clients in the very first year of its operations.

Targeted at the millennials, Liv., allows paperless account opening, extended usage of social media channels for funds transfers, features like instant bill splits, expense tagging, fast 60-second international remittances, updates curated and personalized basis the individual, guiding them to selected events, deals in the UAE.

Abu Dhabi Islamic Bank has also tied up with Europe-based Fidor Bank to provide community-based digital banking solutions. The offerings specifically cater to Gen Y and match their banking requirements. Additionally, they offer the users a platform to exchange financial advice within the enclosed community and co-create banking products.

Open, a new-age neo banking startup from India that focuses on offerings customized to SMEs and start-ups is already on its way to expanding in the GCC region.

Xpence, another Neo Banking that caters to the region’s entrepreneurial needs, is proud of doing the same. It is a bank by and for entrepreneurs that perfectly align, answers, and smoothens the banking issues of freelancers, entrepreneurs, and start-ups. It offers varied automated tags and assists in bookkeeping and Neo Banking simultaneously through a single app. Clients can have a real-time view of their incomes and expenditures which helps them take significant business decisions, in a timely. The services are backed by Microsoft technology and the open-source technology of Apache. It also integrates with tech partners like Paymentology from London.

In the GCC region, we have Saudi Arabia emerging as the front-runner in online and mobile banking solutions. With over three-quarters of its customers using one or the other digital banking solution.

Alinma Bank has come up with a network of digital banking branches across the kingdom.

We also have the Saudi Al Rajhi, the world’s largest Islamic Bank going digital in collaboration with a software company named Temenos.

In the recent past, Bahrain has also seen the launch of Meem Digital Bank, which confirms the ‘Sharia’ norms. And, a strategic digital partnership between the National Bank of Bahrain (NBB) and Almoayyed International Group. Wherein the latter will offer digital payments and trade finance services for corporate use.

New age challenger banks like Kard empower teens to hold their own bank account in addition to issuing them a Mastercard debit card, and their own IABN. This is in line with the recent studies that depict that over 70% of Gen Z conducts banking transactions through online channels.

Social Finance (SoFi), a personal finance organization that offers student loans, refinancing options, personal loans, and mortgage services is expected to raise $500 million from the Qatar Investment Authority, putting it close to a valuation of $4.3 billion.

New Neo Banking for the SMEs

Speaking to The National, Rohit Garg Mashreq’s Head of Business Banking shared prominent banking issues faced by the SMEs all across. “SMEs have been frustrated by the amount of time, personal involvement, and multiple visits it takes to open an account and conduct transactions. Another complaint is that the experience is not uniform”.

And, so we have the following SME Focused Neo-Banks

Mashreq NeoBiz is an exclusive digital bank that caters to SMEs, start-ups, and entrepreneurial banking requirements.

In the year 2018 Dubai Holdings also vowed to invest AED 1 billion over a period of five years, to launch a digital bank in UAE.

Minister of Commerce and Investment Dr. Majid bin Abdullah al-Qasabi has also shared the plans to launch a digital bank in collaboration with World Bank. Herein, the bank would specifically cater to the needs of small and medium enterprises.

E20, launched by Emirates NBD, is another one of their offerings in the digital banking space after achieving success with Liv. Here, the target customers are entrepreneurs and SMEs who work in the capacity of sole proprietors, freelancers, etc. through insurtechs, small-medium enterprises, and require banking solutions on the move. The bank provides regular banking transactions from account opening to payment transactions, over a mobile app. A 24*7 support service through live chat ensures that they are not stuck up anywhere. E20 makes decision-making easier through automated invoices, receivable tracking, reconciliation reports, and more. Helping the SME to keep rolling at all times.

Hylo another promising ‘Neo Banking‘ of the ‘New Age’ addresses the problems of delayed payments by expediting receivables and reconciling the payments against invoices in the SME world. Hylo is already demonstrating a strong presence in India with extended offerings like establishing an account aggregation layer over open bank APIs; it has already entered into a successful partnership with HDFC, for the same. It is also in advanced talks to do the same with more such banks in India and UAE.

From the looks of it, Neo Banking seems to be perfectly aligned to the ‘New’ age banking requirements. Traversing continents and offering customized banking solutions to individuals and corporates basis their personal/professional requirements. GCC is opening different arenas for Neo Banks to explore, and the current opportunities are just a preview of the future ‘Neo Banking’.

Share your thoughts and comments with us below on what’s your take on the current Neo-Bank rage in GCC. Also, delve deep into SME Market Analysis in UAE in 2019 through our blog. If you are open to exploring more options in SME-focused Neo Banking solutions in GCC and India, reach out to us right away at Hylo.