e-invoice and e-way bill under GST is mandatory and an integral part of the functioning of any business. The e-Invoice System allows GST-registered businesses to upload all B2B invoices to the Invoice Registration Portal (IRP). The IRP produces and provides to the user a unique Invoice Reference Number (IRN), digitally signed e-invoice, and QR code, and then the e-way bill is generated.

The e-invoice threshold for businesses is Rs. 10 crores since October 10, 2022, as per the new GOI mandates

Small businesses face several challenges due to a lack of resources and technological reach. E-invoice being mandatory, managing it only adds to another challenge a small business faces.

E-invoicing becomes a hurdle and if not done right could shake the stability of the business.

Therefore, MSMEs would need a fintech application that can automate their e-invoice and e-way bill compliance process.

Before we discuss the MSME challenges related to e-invoice and e-way bills and how Hylobiz simplifies the process for you, let’s have a look at how e-invoices and e-way bills could benefit your business.

The advantages of e-invoice and e-way bill include

- Enhanced efficiency and cost savings.

- Ability to reduce errors and thus the risk of messing up data which could create a huge loss.

- Less paperwork reduces manpower.

- Less expenditure

- Increased capital performance

- Improvement in business efficiency

What are the challenges MSMEs face while creating e-invoice and e-way bill?

- Lack of awareness about the procedure.

Many small businesses may be unaware of the many stages required in making e-invoices as well as how to utilize the various technologies and platforms available. - Lack of money and technical infrastructure.

Many small firms may lack the resources and infrastructure required to generate e-invoices and e-way bills. This can be a significant challenge because these papers require certain tools and platforms to be developed and sent. - Lack of standardization.

E-invoice and e-way bill are often required to be in a specific format and follow certain guidelines. However, small businesses may not be aware of these guidelines or may not have the necessary tools to create documents that adhere to these standards.

Most MSMEs do not spend heavily on technology. The GST system requires firms to upload invoice-related data to a designated online portal via their in-house ERP software. This data must be sent to the electronic schema in a certain format. This will record information on the source and recipient, as well as the invoice details. Hence, data uploading and processing will be a huge task for businesses as it s time-consuming and there’s a chance of errors coming up.

How to address these challenges?

Automation of e-invoice and e-way bill process

By automating repetitive operations, eliminating human error, and offering real-time monitoring and reporting capabilities, compliance automation can help firms decrease the risk of non-compliance and boost productivity. Furthermore, automation can cut expenses, making compliance with rules and standards more affordable for enterprises of all sizes. But the real question is how your business can do all these.

Do you face delayed and messed up invoice collection?

No fear when Hylobiz is here! Let me tell you how can we help!

Faster and more accurate invoice collection could now be right at your fingertips.

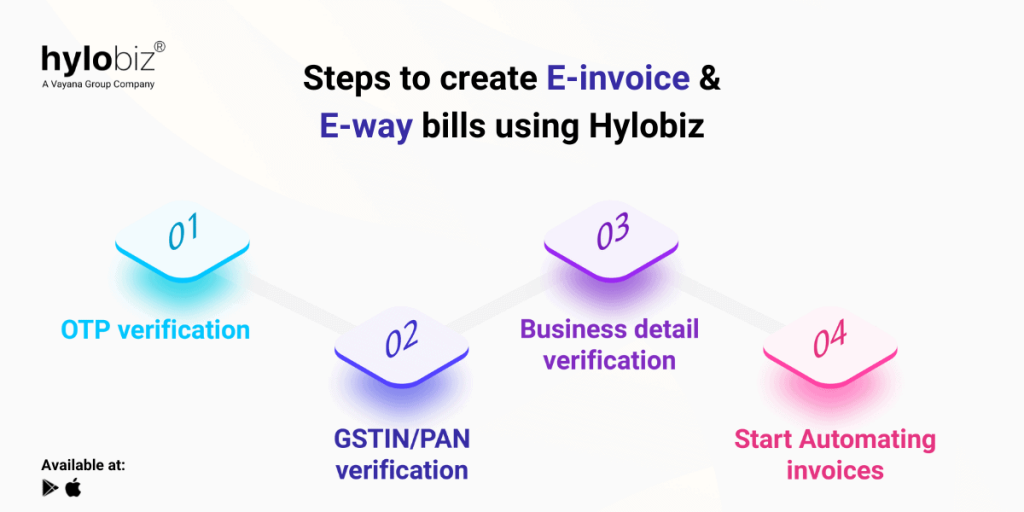

How can you create an e-invoice and e-way bill using Hylobiz?

Step 1– Mobile number and OTP verification.

Step 2– Verify your business using your GSTIN/PAN.

Step 3– Business details verification.

Step 4– Once the account is created, you can automate your collection, create an e-invoice, get your good business score, or just have a look at the app.

Here are some benefits of using Hylobiz

- Automate the billing and payment process

Invoices can be sent and paid more quickly with payment links. This can help reduce the time it takes for a business to receive payment for its products or services. - Improved accuracy

Reduced errors in the billing process can lead to faster payment. For example, if an invoice contains a mistake, the software can alert the business and allow them to quickly correct the issue. - Smart dashboard

You can maximize ITC claims and improve your business decisions with the help of automated business reports available on the dashboard. - Easy tracking and reconciliation

The Hylobiz platform can provide businesses with a centralized system for tracking and managing invoices. This can make it easier for businesses to reconcile their accounts and ensure that all payments have been received. - Automated reminders engine

You can nudge your customers for overdue payments through payment reminders. Make money collection easier by sending payment reminders through SMS/WhatsApp/Email. Create your own rules to control the stage, frequency, and duration of reminders. - Digital Ledger

Improve your business relationships by using our digital and shared ledger, which offers real-time transaction updates and automated reconciliation. - Easy Integration of ERP and Bank Account

With Hylobiz, you can seamlessly connect with your ERP, decrease human mistakes, and optimize your collections.

Overall, using Hylobiz you can help streamline the payment process, get easy access to working capital, and provide businesses with an easy way to track and manage their invoices.

To summarise, small businesses can easily create e-invoice and e-way bill on the Hylobiz platform and stay up to speed with the GST mandates. Small businesses can now overcome the hurdles of e-invoicing and reap the benefits of this efficient and cost-effective system by following these guidelines.

Read our related article on e-invoice and e-way bill

Sign up today: https://app.hylo.biz/login

Know more on Hylobiz: https://hylo.biz/

Read more of our blogs: https://hylo.biz/blogs/

Reach us: support@hylobiz.com