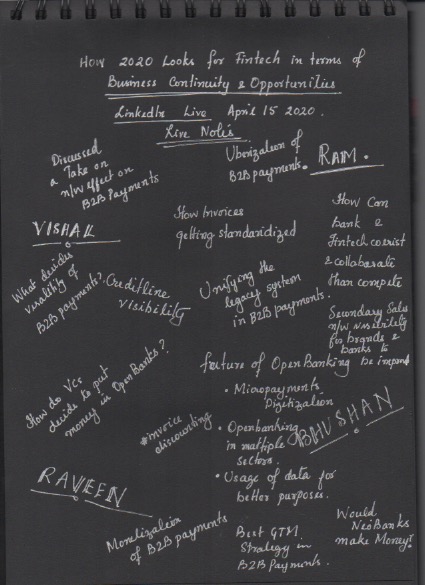

HyloBiz conducted a YouTube LIVE Session with three fintech experts to gather their insights on how the year 2020 shapes out for fintech, in terms of business continuity and opportunities. This informative session was moderated by Mr. Raveen Sastry and the three experts on the panel were Mr. Ram Rastogi, Mr. Bhushan Patil, and Mr. Vishal Gupta.

Raveen opened the session by stressing upon the fact that the digital payment revolution has been spearheaded in India by NPCI and it has proliferated to a level wherein we even pay for our roadside ‘cuppa of chai’ by using UPI.

Taking the discussion ahead, Raveen then asked Ram’s thoughts on what needs to be done in terms of regulations, reach, structure, and usability to help SME and micro SME get on the band wagon of digital payments. Ram shared that although India accounts for 51 million SMEs making monetary transactions worth a trillion dollars, the digital footprint accounts to a meagre 300 million. He suggested that the remaining 700 million could well be a ‘delta’, which needs to be tapped upon. And, this is what opens opportunities galore. Ram also threw light on the fact that traditional banks in their current position aren’t able to offer a comprehensive transaction management system to SMEs. Where they could offer services to manage an SMEs expense management, invoice management, receivables, or credit management systems. This gives rise to the requirement of having Softwares as a Service (saas) for filling these gaps. And, most certainly opportunity for Open Banks/Neo Banks.

He mentioned that there were indeed gaps in the traditional banking systems. Wherein, traditional banks because of their legacy infrastructure are unable to create a Network Effect. “When my creditor becomes a receiver to somebody else it becomes a challenge for the bank. Banks are not able to create a Network Effect…value chain and invoice management issue is there”. He mentioned that RBI is trying to regulate fintech (so that fintech comes at par with banks). Since, SME sector is going at the rate of 39% and is a part of 40% GDP. If Open Banks and Neo Banks can work under certain regulatory framework, they can pitch in to provide safe, secure and easy systems for money transfers…in a way completing the network. So, fintechs have a great opportunity to tap the SME payment digitization process.

He shared that the good part is that Venture Capitalists (VCs) have recognized the significance of B2B segment. In 2019 they invested 657 million dollars as against a lesser amount in B2C. So, all in all it’s a positive run for the fintech.

Raveen then moved the discussion to Vishal and sought his views on the Network Effect and his go to market strategy to strengthen the same.Here Vishal mentioned that over the last 3-5 years, the financial infrastructure has indeed strengthened in the country. Especially so in the B2C sector. Multitude of wallets, banks, and tools are working on the same network. And, NPCI has come out with IMPS, Rupay, UPI…

However, he agreed to the fact that there were a lot of challenges in the SME space. For instance, even before a payment is processed, PO needs to travel between SME, brand, and distributor. Then there are connection issues with GST servers and of course SME feels the itch when multiple parties are operating in silos. It takes up a lot of time and effort to smoothen systems and speak a common language. Different tools and ERPs being used by distributors up and down their own value chain and then when those tools and systems do not talk to each other, transactions get stuck. So, he mentioned there was a clear cut need to make these different systems speak to each other at the SME payment side. This is where solutions offered by HyloBiz also pitch in to offer that “glue” to bind the entire fabric together.

Further on being asked about any “standardization” happening in the digital payments. Vishal was optimistic. He mentioned that with new regulations in place, some level of standardization is already happening at the payments side, with invoices from different tools now talking to GST servers. And moving further “Open Banks/Neo Banks “will work to manage the communication between different legacy systems of the banks. They have their hands full by way of connecting different ERP systems, accounting tools, and more. But the scope is good for neo banks to evolve as banks do not have the visibility on their clients beyond a certain stage. And, this is where they can tap in by enhancing this Network Visibility both for the SME and the bank.

In the same context Bhushan mentioned that the derived opportunities by way of huge database that the Neo Banks can access… they can think of ways to upsell and cross sell with the banks and its clients. And, this is something very attractive to the VCs as well, from an investment stand point.

Ram also suggested that banks and FinTech’s have a great opportunity to collaborate beyond the investments. If Open Banks are open to a paradigm shift and willing to operate in regulatory framework they can be as opaque and transparent to earn the trust and fill in the gaps that legacy banking systems leave.

Answering to Raveen’s query on how Open Banks can make money and still remain hot after the Covid wave passes, Bhushan mentioned that investors do not put in money for a current story. They keenly look for a story that carves within the next 3-5 years. So, he was optimistic that ‘Open Banks’ have a good standing.

He reiterated that traditional banks with their legacy systems do not have the view of a complete transaction that happens. For instance, they would not know of how a person would use the loan that he just took. However, Open Banks have a good opportunity there. He mentioned that we need services at the Point of Sale. For instance, during a B2B transaction, we have an invoice at hand… so we would need invoice discounting that time. It should not linger on with a need to go to a traditional bank and filling a form. Traditional banks lag this real time service provision. So, yes Open Banks have a dedicated place in this ecosystem. This positioning would help them to charge service fees from the merchants in addition to grabbing an ever-increasing piece of pie (new customers) coming from traditional banks in search of end-to-end services. He also views the huge amount of data that is passed on from traditional to open banks, as a great source of money in the future.

Ram also shared that with a 51 million whopping number, SME segment is huge. Open Banks play the role of facilitators between customers and bank and can make more money in the process. They need to work while abiding mandates and regulations set for them and work hand in hand with the banks to offer end to end services to SMEs.

Moving further into the discussion, Vishal spoke of the three schools of thoughts behind successful Open Banks. First like the Revolut and N26, which are full blown Open Banks with set UI/UX systems in place and hold licenses and are fully regulated. The second case is of Sponsored Neo Banks like HyloBiz, which have banks supporting them from behind, however, do not fall under any regulations per se. Then there are marketplace banks, linking back to different ERPs and connecting different segments. Vishal mentioned that all the above work on different principles and HyloBiz works like a network fabric connecting the different segments, ERPs and payment processes of its customers. He added that SMEs do see value in what HyloBiz is offering and are willing to pay revenue for the same.

HyloBiz helps ease the communication issues up and down the value chain of an SME. It helps in standardization using SaaS when SMEs use different accounting tools and ERPs at different ends of their systems. He shared that once they are able to align thousands of such wrinkled transactions seamlessly, they can also approach the banks to understand more opportunities to upsell and cross sell their services.

Closing on in this discussion, the panelists shared the three upcoming trends that they see in next 12-18 months. While Vishal shared that he sees cost effective, seamless and friction less payments in the entire value chain. Ram suggested that offering transactions with some added value could be a win-win for the business community. And, this is how smart businesses can make money post COVID. With private blockchain and digital currency, future is looking sharper.

Bhushan also added that in the next 12-18 months he certainly sees unification happening across wallets and UPI. Secondly, SMBs need to come up with efficient solutions that relate with the changing world environment. Data privacy and security in the B2B is another avenue that needs focus in the near future, with constant uberization. The entire value chain must work on digital payments, not just one half or a portion of it.

All in all, a lot of business opportunities for the Fintech in the coming year and we are hopeful!